Upgrading SCF: case study

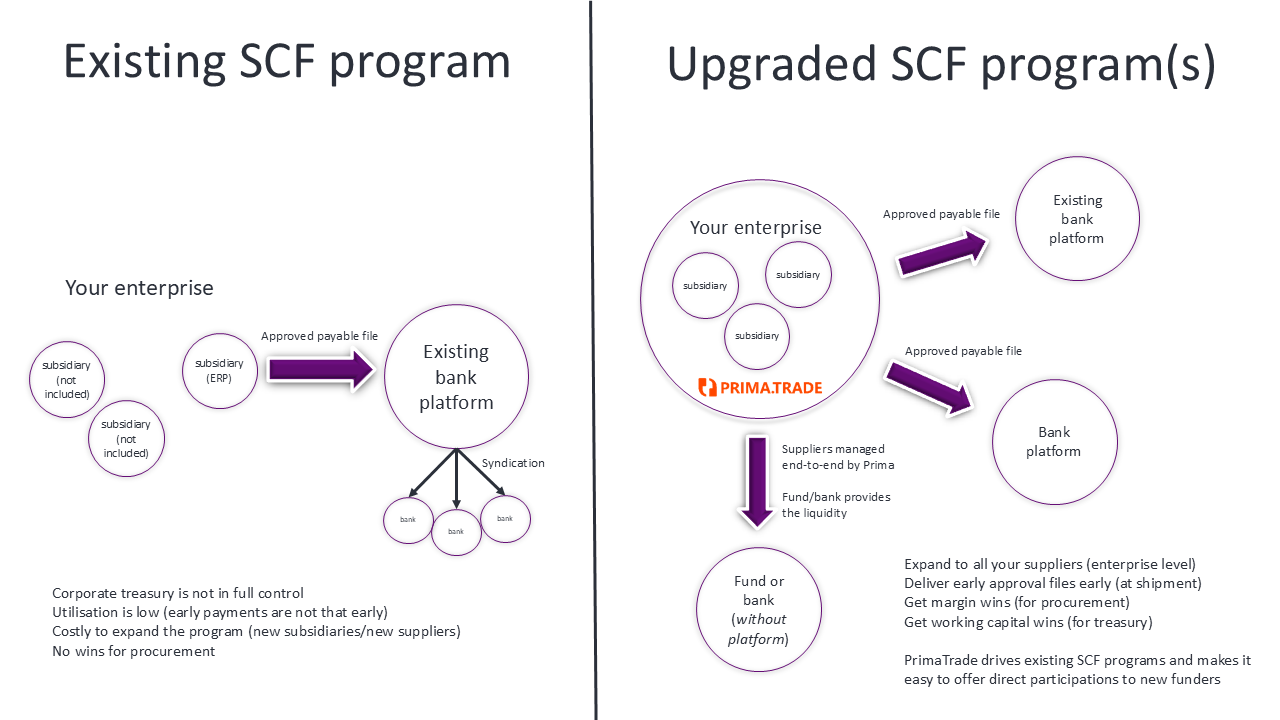

For many corporates, supply chain finance ("SCF") fails to live up to its potential.

Corporate treasurers and CFOs tell us about underutilization, limitations on the scope of programs, and a lack of transparency.

A large, global corporate is upgrading their existing SCF program - read this 3 minute case study.

PrimaTrade provides a smart and streamlined approach. We upgrade existing SCF programs with minimal disruption.

It is simple to implement, maximizes supplier participation, expands scope to the enterprise level, automates processes and puts corporate treasury teams in control - achieved without material changes to existing SCF programs.

Take control by upgrading your SCF

The corporate is a global multinational with multiple operating hubs. They have a large SCF program implemented in only one hub.

This existing SCF program is managed by a relationship bank on its in-house SCF platform. There is an active syndication process behind the scenes to distribute participations to relationship banks.

Their existing SCF program is falling short of expectations:

Supplier utilisation is low

Manual work is required in finance and accounts payable teams

The corporate is not in control and the program is not transparent

Automate approvals and expand utilisation

The corporate buyer has three main objectives:

Expand the program to all suppliers, and roll it out to new operating hubs

Increase utilisation by making the program more attractive to suppliers and internally to procurement

Enable direct participations by its relationship banks

Upgrade without material changes

They have given us three important constraints:

Procurement colleagues need a win so that the program can be expanded with all teams pulling together

Automation is required on early payment decisions to minimise the work for accounts payable teams and in new operating centres

No material changes to the existing program documentation should be required

PrimaTrade: delivering P&L and utilisation

PrimaTrade's platform can be added to the existing SCF program operated by the bank, delivering the objectives whilst observing the constraints.

PrimaTrade's platform is used to manage the corporate's side of the SCF processes involved.

Upgrading SCF with PrimaTrade

PrimaTrade's platform is used to:

Automate early payment approvals

This relieves internal pressures on finance teams

and enables more operating centres to be added easily to the program

Make early payments truly early (at shipment)

This makes the early payment offer valuable for suppliers

Monetise supplier discounts for early payments

This enables procurement to benefit directly from lower prices

Allocate early payment approvals across different funders

This enables funders to participate directly under corporate control

How does PrimaTrade do this?

PrimaTrade can achieve these results because our platform is powered by data from suppliers provided at shipment.

This enables the PrimaTrade platform to be implemented across the enterprise, without significant IT work for operating hubs.

The PrimaTrade support is self-contained and standalone - so existing finance personnel and systems are not disrupted.

We operate as a corporate-side platform. Funders do not need to use the PrimaTrade platform to provide supply chain finance.

What about the existing SCF program?

The existing SCF program is driven by a simple "approved payable" file. This file is produced from its accounting system each time there is a utilisation of the program.

That same approved payable file is created by PrimaTrade instead - so the funder gets exactly the same file but earlier, with P&L wins, with automation and across the whole enterprise.

And adding new funders?

Each new funder will usually have its own way to receive an approved payable file for an SCF program - perhaps onto its own platform or direct to its banking systems.

Adding new funders is straightfoward. PrimaTrade simply outputs an approved payable file to each funder in the format they require. If funders do not have their own SCF platform, they can choose to use PrimaTrade themselves.

And now the corporate is in control.

Corporate treasury decides who should get what on the PrimaTrade platform.

What is the result?

The existing bank platform and SCF program is simply fed from PrimaTrade instead of the buyer's accounting system.

The approval file is now delivered on day 2/3/4 after shipment and not day 10/20/30.

All the operating centres and suppliers across the enterprise can be added.

The existing SCF program documents do not need to be renegotiated and the program can continue without material amendments.

And:

Relationship banks can participate directly; the allocation of invoices is done centrally on PrimaTrade and with each bank receiving their own approved payable file.

The P&L win delivered to procurement by monetising supplier discounts means the whole corporate organisation has a benefit from SCF.

Are we delivering?

Benefits are immediate, realised with minimum IT effort and without needing changes to the existing SCF program.

Ready to make your SCF work smarter?

Contact us today to discover how PrimaTrade can boost your SCF performance—without the hassle

Get in touch with us now to find out more. Click here to send an email or here to book a call.