3 major SCF pain points

New technologies are emerging in supply chain finance that can inject more life into the industry – delivering significant efficiencies and benefits to clients whilst substantially improving the performance of programs for financiers.

This note, based on our recent survey of global heads of SCF at leading banks, sets out the 3 biggest SCF pain points and how new approaches, in combination, deliver solutions that work for everyone.

SCF is limited by its pain points

Supply chain finance: not small!

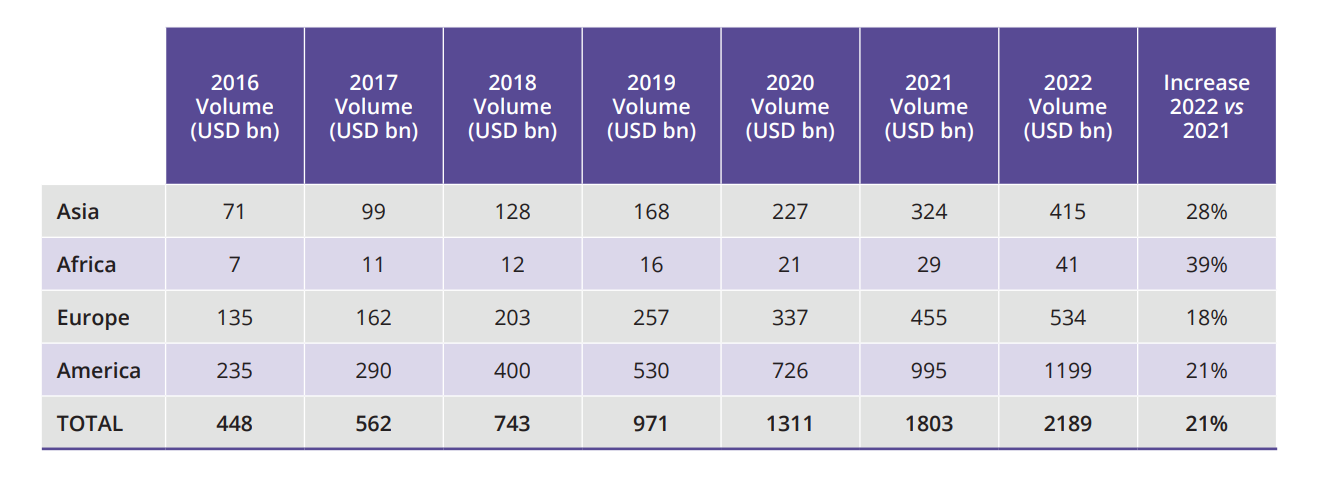

Supply chain finance is a US$2bn revenue industry for bankers globally. This figure is an average total that we have found amongst the global heads of supply chain at major banks whom we have spoken to in the last few weeks. And that’s not a small number in banking today.

Extrapolating from that figure, we might estimate that approaching US$2 trillion in payables are accelerated each year using some flavour of supply chain finance.

This matches well with the 2022 BCR Annual World SCF survey:

BCR World Supply Chain Finance Report 2023

What are the 3 major SCF pain points?

Commentators may disagree, but our recent informal survey of the top banking players in SCF indicates that these three topics are at the top of the in-trays of global heads of SCF today:

Utilisation levels in their SCF programs

Inclusion of all the suppliers, especially the long tail

Integration of supply chain finance natively into the supply chain process (eg: so approvals arrive quickly and automatically)

These issues are inter-linked and delivering a solution requires a joined-up approach. Most importantly, this is a mature market and participants will often have existing platforms whether in-house or external.

Any solution has to be able to work as a wrap-around to existing platforms as well as standalone.

Let’s take each topic in turn.

Pain point 1: utilisation levels in SCF programs

Utilisation levels in SCF programs hit significant highs through the pandemic when supplier liquidity was under stress, and supply chain disruptions were at a peak. Suppliers had difficulties shipping their goods and therefore getting timely payment and buyer credit risk was uncertain. SCF programs were a boon.

These were heady days, but business as usual has now returned. And of course, management expectations in most banks have not adjusted – so revenues from SCF are expected to keep growing but market conditions have, perhaps, gone the other way.

Utilisation of most SCF programs is low because SCF is not available as part of the shipment process.

The supplier process is focussed on shipment. This is when goods are handled, documents processed, communications flow with the buyer. But with SCF suppliers have to look out for separate and much later notifications that their receivables are approved, and typically after that they have to log into a separte SCF platform to see if funding is available. This is often 30-40-50 even 60 days after shipment depending on the buyer invoice approval process.

So this is an extra step, an extra log in and separated in time from the shipment itself. And the later the approval comes, the less valuable the acceleration of payment.

And why the delay? That’s because most buyers don't have a specific process to green-light invoices for supply chain finance quickly so that funds can be drawn by the supplier as they ship. Invoice approvals take time because they mostly happen after delivery, and who is in a hurry to approve an invoice when the standard invoice term is 90+ days?

Pain point 2: including all the suppliers, especially the long tail

Most supply chain finance programs only target the larger suppliers following the classic 80:20 rule. 80% of the supply comes from 20% of the suppliers, so only these larger suppliers get on-boarded and made eligible for accelerated payments.

This approach materially contributes to the US$2.5 trillion “trade finance gap” for SMEs (2023 figure, up from US$2 trillion in 2022) - source ADB.

There are two main reasons why this happens:

Finance and sourcing departments do not want to explain SCF to smaller suppliers and go through the process of setting them up for early approvals, especially if there are manual steps; and

Funders (typically banks) do not want to on-board the smaller suppliers because of the cost and complexity of KYC and AML procedures.

Limiting SCF programs only to larger suppliers leads to lower utilisation and reduces the benefit that the buyer and his suppliers can receive.

It is the smaller suppliers that really need the liquidity – but they are the ones excluded - see above the US$2.5 trillion trade finance gap.

It can also increase the risk that SCF is accounted for as short term debt – since all suppliers are not being treated by the buyer in the same way; and

There can be ESG and compliance concerns if SME suppliers or suppliers located in emerging markets are discriminated against.

In fact, to maximise the benefit that the buyer receives, it is essential that SCF programs are expanded to help the smaller suppliers – but how?

Pain point 3: integrating SCF into the buyer and supplier process

As already explained, most SCF processes are separated in time and platform from the business-as-usual activity of shipping goods to the buyer.

But there is another dimension to this, which is that most buyers implement an exceptional process for preferred suppliers to get approval decisions made quickly so that supply chain finance can work.

And this comes at a cost and with potential control risks.

Finance departments need a safe, automatic and real-time way to evaluate all invoices at shipment for IPU issuance (ie: early approval); then SCF can be handled in the ordinary course of business and suppliers can access SCF as natural part of their supplier journey.

But how?

The solution: what’s the fix?

The solution requires three areas to be tackled:

Delivering IPU Automation

Making supplier on-boarding easy

Integrating SCF into the supplier journey

IPU Automation: The IPU (irrevocable payment undertaking) is a standard document used in supply chain finance. It is the buyer’s confirmation that it will pay the invoice. Funders will not normally provide finance to the supplier (accelerated payment) until the IPU is provided.

If IPUs can be delivered automatically and quickly, this will maximise the efficiency of the SCF program whilst also not disturbing the traditional 3-way match, evaluation of shipments after delivery and approval of invoices by the finance department.

IPU automation resolves the cost and control questions in the buyer’s finance department and delivers decisions to the supplier at shipment.

Supplier on-boarding: All suppliers need to be eligible regardless of geography, product, transport method etc. and this means that the costs of on-boarding need to be solved. Many funders now have systems that help with supplier on-boarding or, even better, this needs to be a process that can be platform-driven ie: handled by the platform rather than the funder - and this allows smaller suppliers and suppliers in difficult jurisdictions to be on-boarded efficiently, quickly and economically.

Platform on-boarding of suppliers resolves the key regulatory obstacle to supplier eligibility.

Supplier journey: The offer of SCF needs to be incorporated into the business-as-usual activity of the supplier so that SCF visibility and the decision to take finance happens naturally via the documentation process that happens each time a supplier ships.

Integration will lead to much greater utilisation of the SCF service because the funding is coming earlier and the supplier’s decision to take the funding becomes a standard part of its activity.

In combination, these three capabilities can lead to all suppliers being eligible and included in SCF programs without increased costs, extra processes and extra risks and delivering IPUs much earlier will lead to higher utilisation.

Prima as a wrap-around

The Prima platform delivers these capabilities and can go live without an initial IT project.

The Prima platform is implemented “over-the-top” of existing activities, delivering IPU automation, solving supplier on-boarding and providing a service where SCF is a native step in the supplier shipment journey.

Prima can be implemented as a wrap-around solution, enhancing an existing SCF program without needing to replace the platform, agree new documents or undertake expensive IT and process enhancements.

To find out more about the Prima platform and how it delivers IPU Automation, solves supplier on-boarding tensions and delivers SCF as a “business-as-usual” process for suppliers, please click here.