Treasury triangle: take control

Supply chains have multiple touch points in organisations.

For Treasury, payment terms to suppliers are crucially important as these are a key driver of working capital - this is "DPO" or days payable outstanding.

And working capital is key to the CFO - who typically has to an operating cash flow KPI set by the board - and corporate treasury is expected to help deliver it.

But supplier payment terms are usually set by other teams – eg: procurement and / or logistics; moreover, any practical adjustments to supplier payment terms and payment processes always involve finance teams.

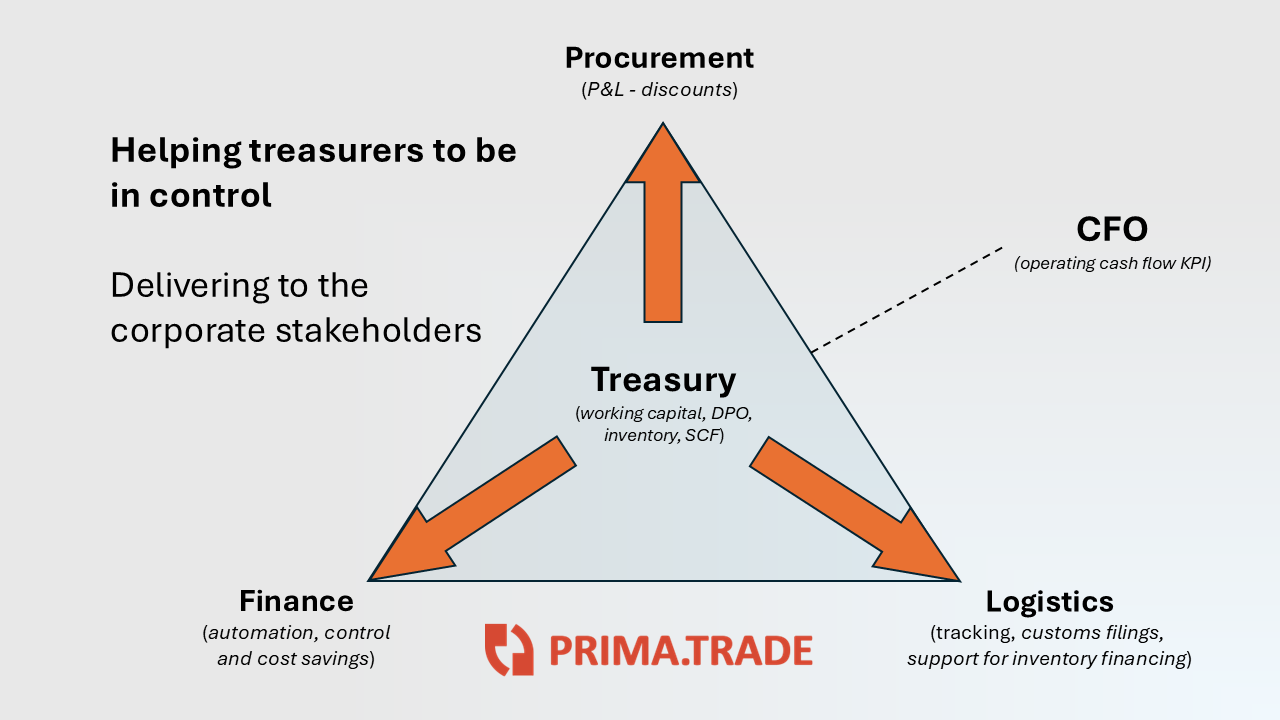

There is a corporate triangle for treasurers to manage.

New approaches to supplier management mean that treasurers have a unique opportunity to gain control over payment terms to suppliers whilst also coordinating wins for procurement, logistics and finance colleagues.

The treasury triangle: working capital

We talk to a lot of corporate treasurers and their bankers. An almost universal frustration is that:

Treasurers are responsible for working capital; BUT

Other people control payment terms with suppliers

There are good reasons why things work this way. It is a "treasury triangle".

Procurement are tasked with sourcing the goods and services that the business consumes, and so own relationships with suppliers.

Logistics are responsible for making sure that goods can be landed without demurrage, for controlling incoterms and crucially how goods move and are stored; logistics positioning drives inventory levels and they are crucial internal partners for any inventory financing program.

Finance are responsible for coordinating the practical process of approving invoices for payment and then paying the right amount to suppliers.

Some treasurers tell us that their task is almost impossible.

The board and CFO are looking for improvements to operating cash flows.

But efforts to lengthen payment terms with suppliers run into commercial blocks from procurement and practical challenges with finance and logistics.

Strategies to implement inventory financing structures run into similar difficulties.

But there is a simple answer.

New approaches can now enable treasurers to take control of supplier payment terms and manage “days payable outstanding” or “DPO” efficiently – and even get stock / inventory off the balance sheet.

Step 1: suppliers provide their data

Data flows into the organisation via different silos and via a variety of different methods, each of which can be out-of-sync with others and it means that it’s hard to make reliable and quick decisions.

So the first step is to get suppliers to provide data about their transactions as they happen, and to use this data to manage payments to the supplier dynamically.

Just ask suppliers to use the portal.

Using new trade digitisation portals like PrimaTrade, it is easy for suppliers to do this. There’s no upfront IT project involved: suppliers simply start processing their paperwork, data flows and the portal manages working capital for you on a self-contained basis.

Step 2: offer instant payments

This is the key.

It is easy to use the data coming from suppliers to implement an automated, instant payment capability using third party funders. Suppliers get paid immediately and automatically for a discount, but you can use bank or funder cash to make the payment.

That means you get the P&L win without the cash flow cost.

This is the secret sauce:

Suppliers are getting a big win via the instant payment, and generally give decent discounts (eg: 3 /4 / 5% on the invoice value).

This win goes to procurement and it is big.

This allows supplier payment terms to be standardised and extended – because suppliers always have an instant payment option.

And this enables the Treasurer to take control over supplier payment terms and therefore DPO.

And the other stakeholders?

Supplier data can be used to automate invoice and finance processes. And, if these are also being being standardised, finance teams get quickly on board - since instant payments can be handled automatically - see how we do this here.

And finally, with suppliers getting paid instantly, transport documents get released quickly and the data provided by suppliers can be used to automate accurate customs filings and to implement inventory financing solutions with automation and without pain for logistics teams.

Step 3: there’s no step 3

Trade digitisation is really this simple - and it puts corporate treasurers back in control over key drivers of working capital: supplier payment terms and balance sheeet inventory levels.

Suppliers do the work

Better data flows more quickly into your business

And you use it to deliver wins across your organisation

And you can go live without an IT project- just put suppliers onto the portal

With working capital now managed by treasury, operating cash flows can be improved and CFOs can meet their operating cash flow KPIs.

What next?

We are trade digitisation experts. There are no sales team here and we are interested in hearing from you.

These new approaches can be implemented easily without IT investment and without risk.

It is a new paradigm - providing control over DPO to corporate treasury.

Give us a call and we can explain! Click here to book a time.