Instant supplier payments

Supply chain finance and supplier finance programs are often getting a bad rap from many corporate treasurers.

Programs are arranged, but then invited suppliers don't take up the early payment offers at scale and the administation for finance teams behind the scenes can be painful.

Why is that?

Early payments are usually not very early

Approving early payments quickly can be difficult for finance teams

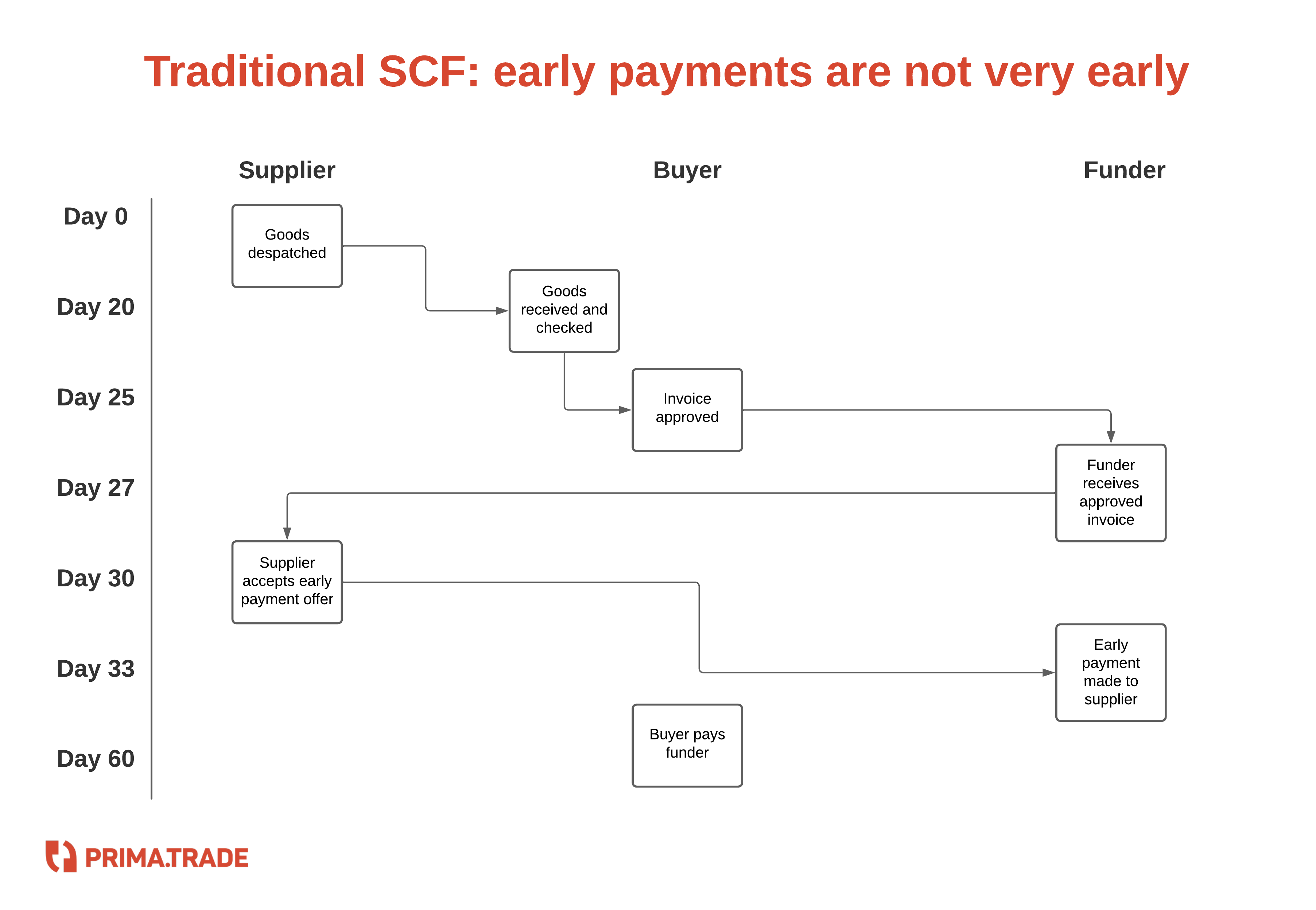

Supplier early payments: traditional SCF model

The supply chain finance industry is 20+ years' old and platforms generally take a similar approach.

The buyer approves the invoice for payment.

Approved invoices are sent to a platform.

The platform coordinates with the supplier who can then ask for early payment.

The financier pays the supplier.

The buyer pays later.

Suppliers can only get early payments once invoices are approved and transmitted to the funder - and this can take 20, 30 even 40 days to happen after goods are despatched.

And this means the offer for suppliers is not very attractive. Early is not very early.

This issue applies for all forms of supplier finance where buyer approvals are required, including payment cards, dynamic discounting and supply chain finance.

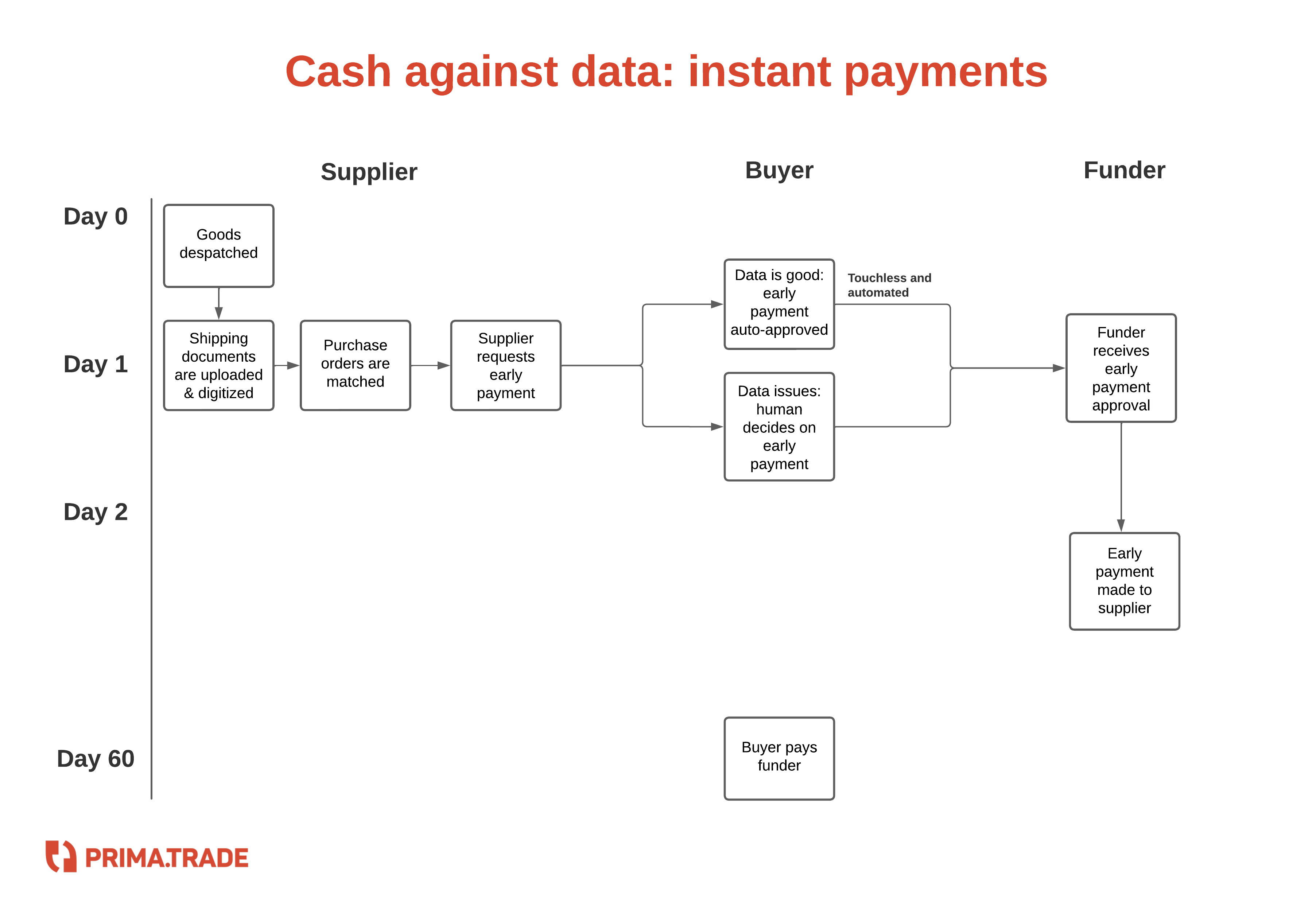

Instant supplier payments: new SCF model

We call this new approach "cash against data". Cash can flow on day 3 and not day 33.

Suppliers:

Self-digitize their paperwork (transport, packing, inspection, invoices)

Match their invoices to the buyer's purchase orders ("PO Match")

Ask for early payment, signing any funder document required

and then:

If the data is inside tolerances set by the buyer, the early payment is automatically approved (ie: touchless, straight-through process)

If the data is outside tolerances, a human needs to review but the data and documents, plus analysis, are available to check

and the funder can disburse payments instantly to the supplier.

Fixing SCF programs

"Cash against data" has been invented by PrimaTrade.

It can be retrofitted to existing programs enabling buyers to open up programs to all their suppliers, adding instant early payments and high levels of automation.

This is what corporate treasurers and CFOs have been waiting for - supplier financing programs that truly add value.

Get in touch with us using this link to find out more.