Trade digitalization: how to start?

There's a growing and visible push to get trade digitalized - and trade documents digitized. See more here.

Read this short post to understand the "what" and the "who" of trade digitalization - and then crucially, "how" you might start the journey yourself.

Below the body of this post (below the line) are some definitions and a framework that we use to make sense of the complicated world of international trade:

Expert and informed readers should continue straight on (2 mins)

Readers wanting to see the context, or who have questions, should check out the materials below the line as well (2 more mins)

The "why" of trade digitalization?

International trade still uses paper documents that may as well have been invented by Queen Victoria herself. It all works, but there are a lot of costs, delays and frictions.

Estimates for the annual cost to all of us for these inefficient processes go into the many US$billions, see for example McKinsey's analysis of the impact of electronic bills of lading here.

But digitalization is not a one-size fits all story.

Two digitization approaches

The big and immediate wins come from the use of new digitization techniques for documents. There are two types:

Digital negotiable instruments ("DNIs") - such as electronic bills of lading ("eBLs") and electronic commitments to pay, such as electronic promissory notes and electronic bills of exchange ("ePNs" and "eBoEs").

Digitization without DNIs - where documents are digitized at source and where bilateral digital agreements between parties can work - such as using an "irrevocable payment undertaking" issued by a buyer to a financier that enables the supplier to be paid instantly.

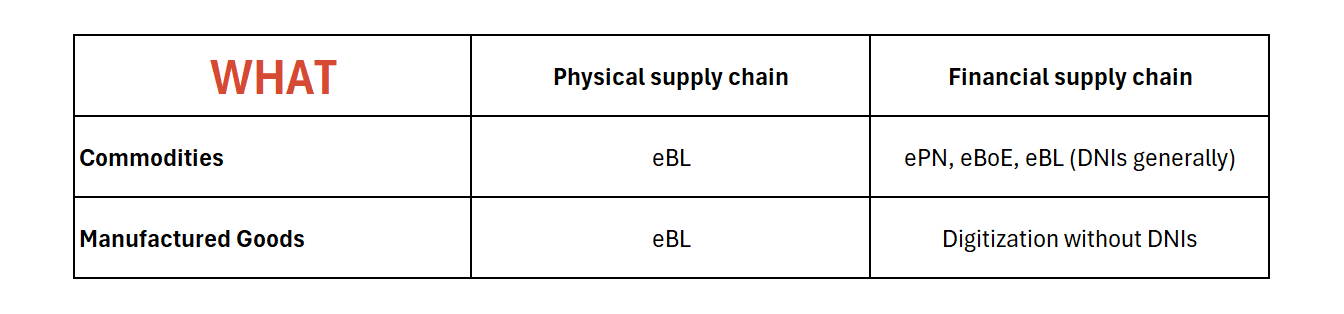

The "what" of trade digitalization

This table shows which type of digitization approach is appropriate and in which context (definitions are below the line later on):

So what do we see here?

eBLs help the physical supply chain to work better, undoubtedly.

In the financial supply chain, digitalization without DNIs is more appropriate for manufacturing supply chains.

That should not be controversial but we do recognise that not everyone would agree with us on the last point. See here for why manufacturing supply chains can be efficiently financed using non-DNI digitization.

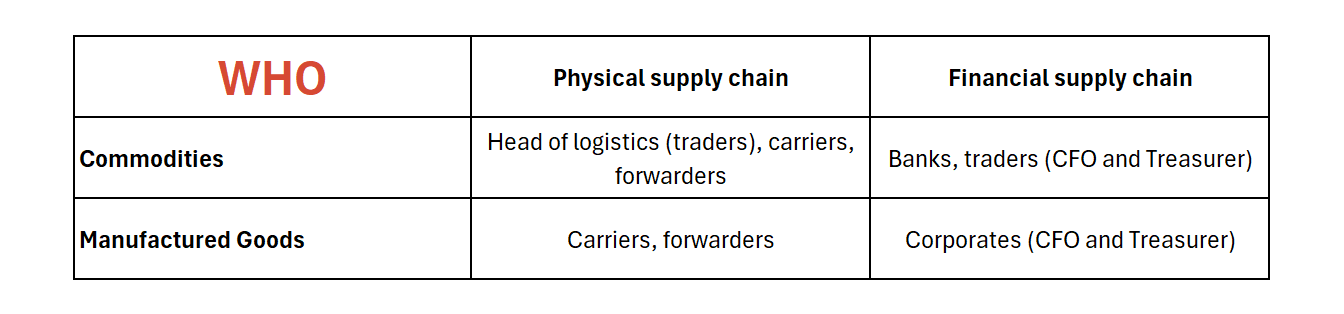

The "who" of trade digitalization

This table shows who is interested in the digitization discussion and who has the power to initiate change:

What do we see here?

Commodity traders and their bankers can drive the change in their area

In manufacturing supply chains, corporates have little influence on the physical supply chain (their individual shipments are too small), and on the financial supply chain, it is the corporate treasurer and CFO who can drive adoption and not the banks.

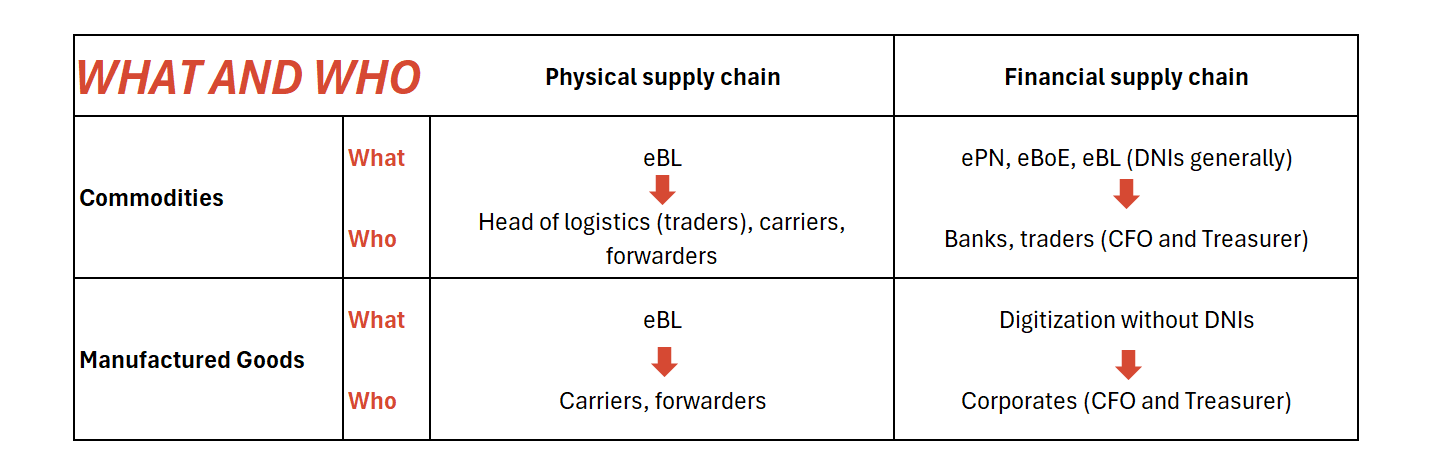

Putting the what and who together

This is how we drive the digitalization agenda forward:

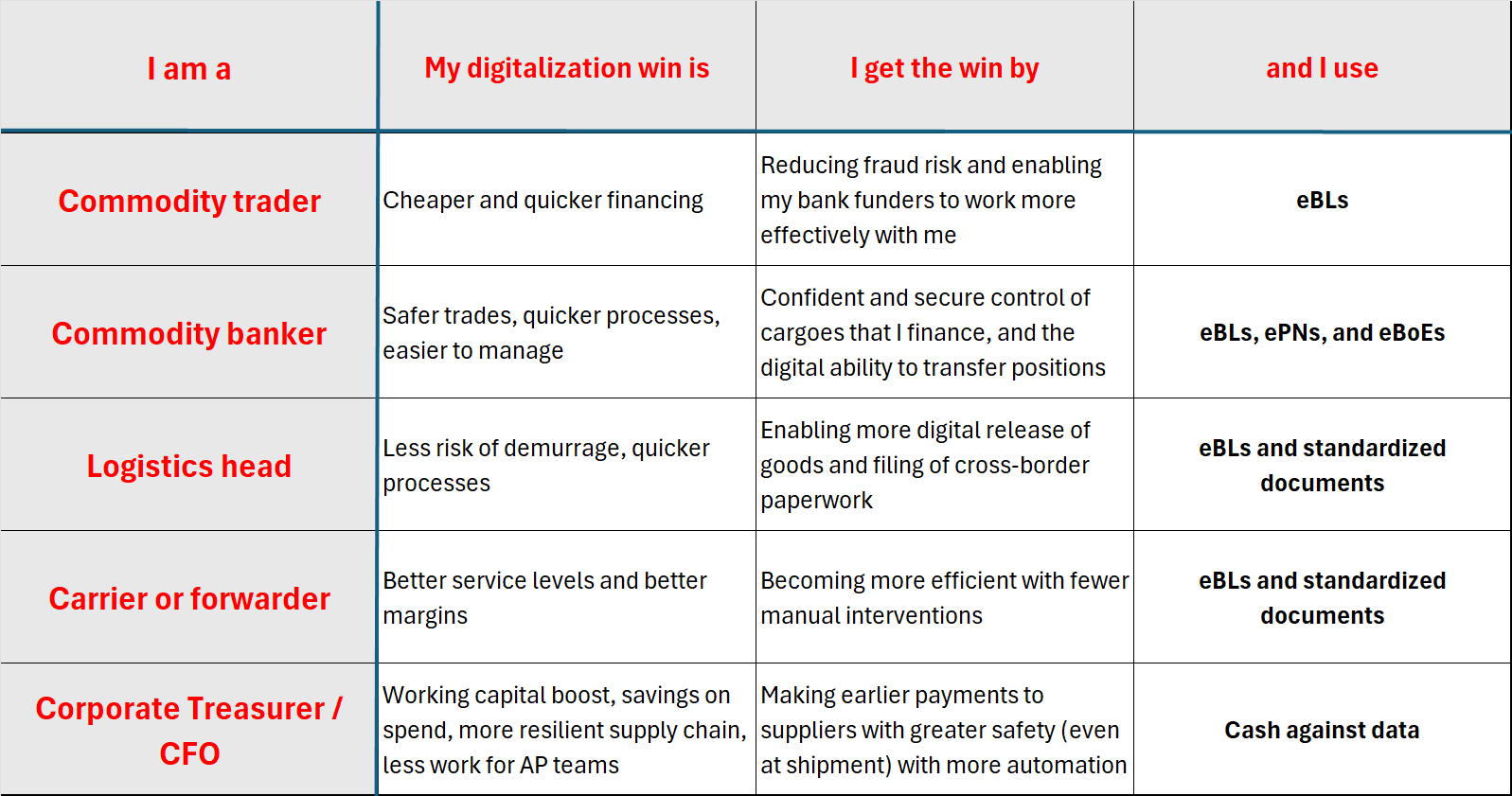

So what next with trade digitalization?

Trade digitalization: how to start?

How you start depends on who you are, the wins available, and which part of the ecosystem you can influence:

Where does PrimaTrade fit in?

PrimaTrade's platform is for corporate treasurers and CFOs with manufacturing supply chains.

We enable corporates with manufacturing supply chains to digitalize their financial supply chains without the need for DNIs:

When suppliers ship, they upload their documents and self-digitize them on PrimaTrade's platform

Using this data, companies can make instant decisions on early payments

And the interaction with financiers is coordinated via legal agreements that are generated and executed directly on the PrimaTrade platform

In the last 18 months, PrimaTrade has digitalized over 40,000 shipments for over 700 companies in 26 countries, saved its clients US$millions in financing costs and generated US$millions in additional working capital.

Digitalization of trade is a big win for everyone - but it is not a one-size fits all topic. Moreover, a lot of digitalization will happen without using DNIs.

Get in touch with us now to find out more. Click here to send an email or here to book a call.

Background materials - trade digitalization: how to start?

Trade digitalization - a framework

There are two dimensions to international trade in goods:

The physical supply chain - moving the goods from A to B

The financial supply chain - moving the cash the other way, from B to A

Moving the goods involves transport documents, customs paperwork and certificates. Moving the cash involves purchase orders, invoices, payments and trade finance.

There are two kinds of international trade in goods, and they work differently:

Trade in commodities like grain, copper, oil, typically shipped in bulk and traded.

Trade in manufactured goods like garments, furniture, electronics and components, typically shipped point-to-point between a supplier and a buyer.

To put some numbers on it:

Trade in manufactured goods is roughly 2x the trade in commodities - but both are massive (the combined total is over US$25 trillion each year).

Physical supply chain inefficiencies lead to frictional costs ($100s per shipment) but these are low relative to the costs of inefficient financing ($1000s per shipment).

There are also different people involved:

Financial people (treasurers and CFOs)

Logistics people (specialists in transport, customs and paperwork)

And they work in different kinds of organisations:

Corporates (with manufacturing supply chains)

Commodity traders

Banks and financiers

Carriers and forwarders

For the terms we are using:

We digitize a document (or digitise it in England)

We digitalize a process (or digitalise it in England)

For more on that discussion, see here.

Standardization - digital standards

There is a significant value in standardising the data that the documents involved in international trade contain. This allows handshakes across borders and between systems can be improved. We must do this. But this is not the subject matter for this short post. See more about this here.

Standardisation is a background, continuing and important task to be getting on with.

DNIs, for example, are a specific class of documents that are supported by the Electronic Trade Documents Act 2023 in the UK and similar legislation (based on MLETR) that is being passed in jurisdictions around the world. This class of documents typically has special characteristics and requires specialist systems to support them.

But DNIs are not the whole story and only need to be used in specific situations.

When do I need a DNI?

Only very few documents are capable of being created as a "DNI" - a digital negotiable instrument. In the context of digital trade, we are only talking about:

Bills of lading

Promissory notes

Bills of exchange

Other documents, like certificates, packing lists, invoices, purchase orders, inspection reports etc. are not capable of being DNIs.

And it is important to think about the features of a DNI:

do you need these features?

might these features actually be a disadvantage?

A DNI, typically, is:

A "bearer" right, so the holder of the document has the rights and benefits conferred by the document.

"Transferable" so the holder today might not be the holder tomorrow.

An example where a DNI is helpful is where control of a cargo is being transferred by multiple parties (eg: commodity traders and their lenders) who need to be able to pass on easily the digital document (eBL) in which that control is vested.

Another example where a DNI might be to organise post-maturity financing of an invoice by settling the invoice on its due date (or earlier) with an electronic bill of exchange or electronic promissory note incorporating a delay in payment that can subsequently be sold and easily transferred to a financier by the receipient (the supplier) for cash.

An example where a DNI might be unhelpful is where a corporate wants to control the identity of financiers that it has to pay money to, and so would prefer not to issue debt to financiers in the form of a DNI, since the claim (and all the rights) might be transferred.

Get in touch with us now to find out more. Click here to send an email or here to book a call.