Digital standards initiative (DSI)

The Digital Standards Initiative ("DSI") is a global initiative set up by the International Chamber of Commerce ("ICC") to help with the process of digitalizing trade.

See here for their detailed report on "Key trade documents and data elements".

This is a very useful analysis of trade documents in use today. We have summarised aspects of the report and we propose some extensions to the analysis. Read on (3 mins).

Digital standards initiative: documents

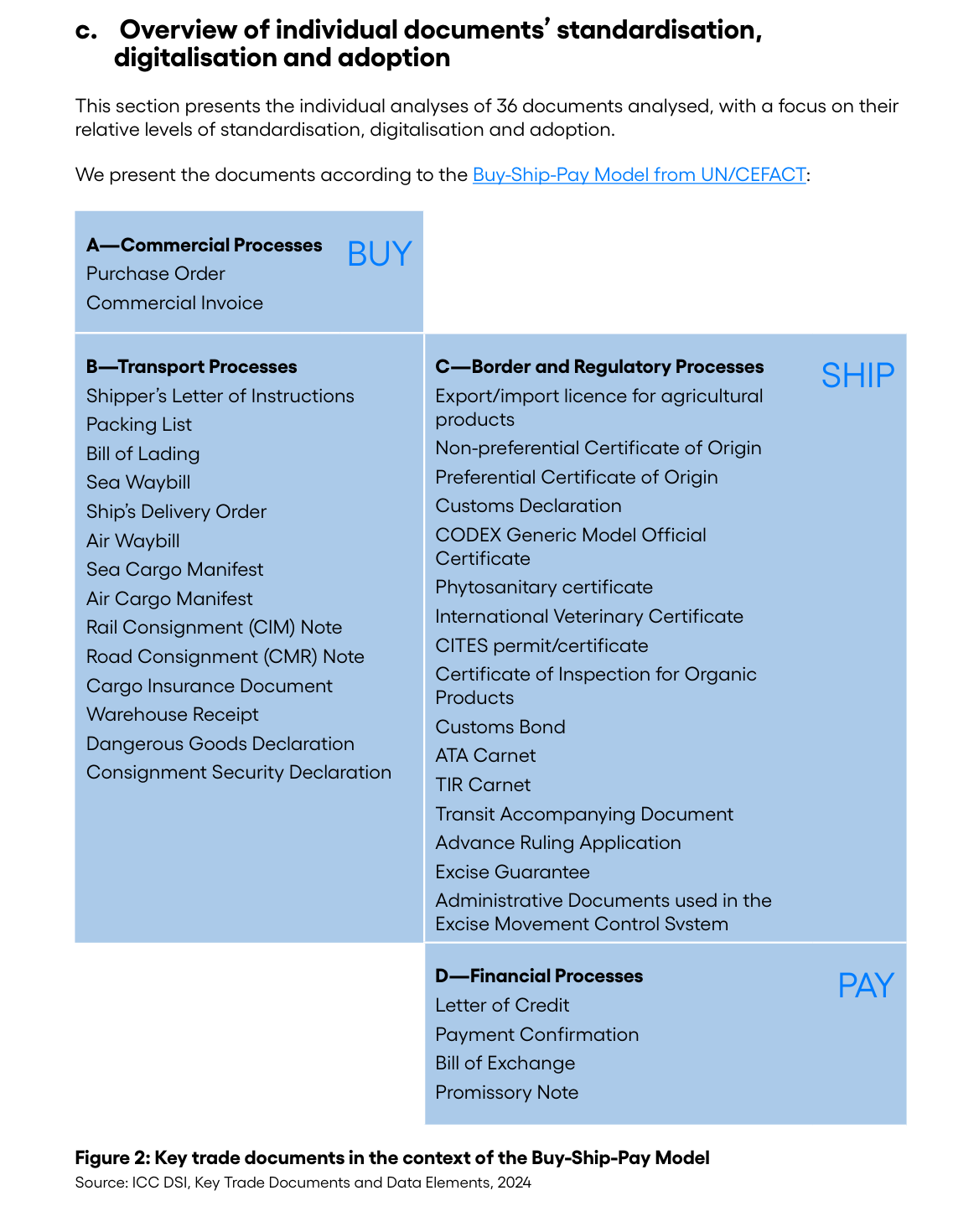

The DSI has identified 36 documents involved in trade covering:

commercial documents (like invoices)

transport documents (like bills of lading)

border and regulatory documents (like customs declarations)

financing documents (like a letter of credit)

This table is taken from the DSI report, page 16, setting out the documents that they have identified and analysed:

Source: Digital Standards Initiative "Key Rated Documents and Data Elements" April 2024

Additional documents

PrimaTrade provides a trade digitalization platform that is scaling fast, already digitizing (at the date of this blog, July 2024) around 30,000 shipments per year across 500 companies in 26 countries supplying and importing manufactured goods.

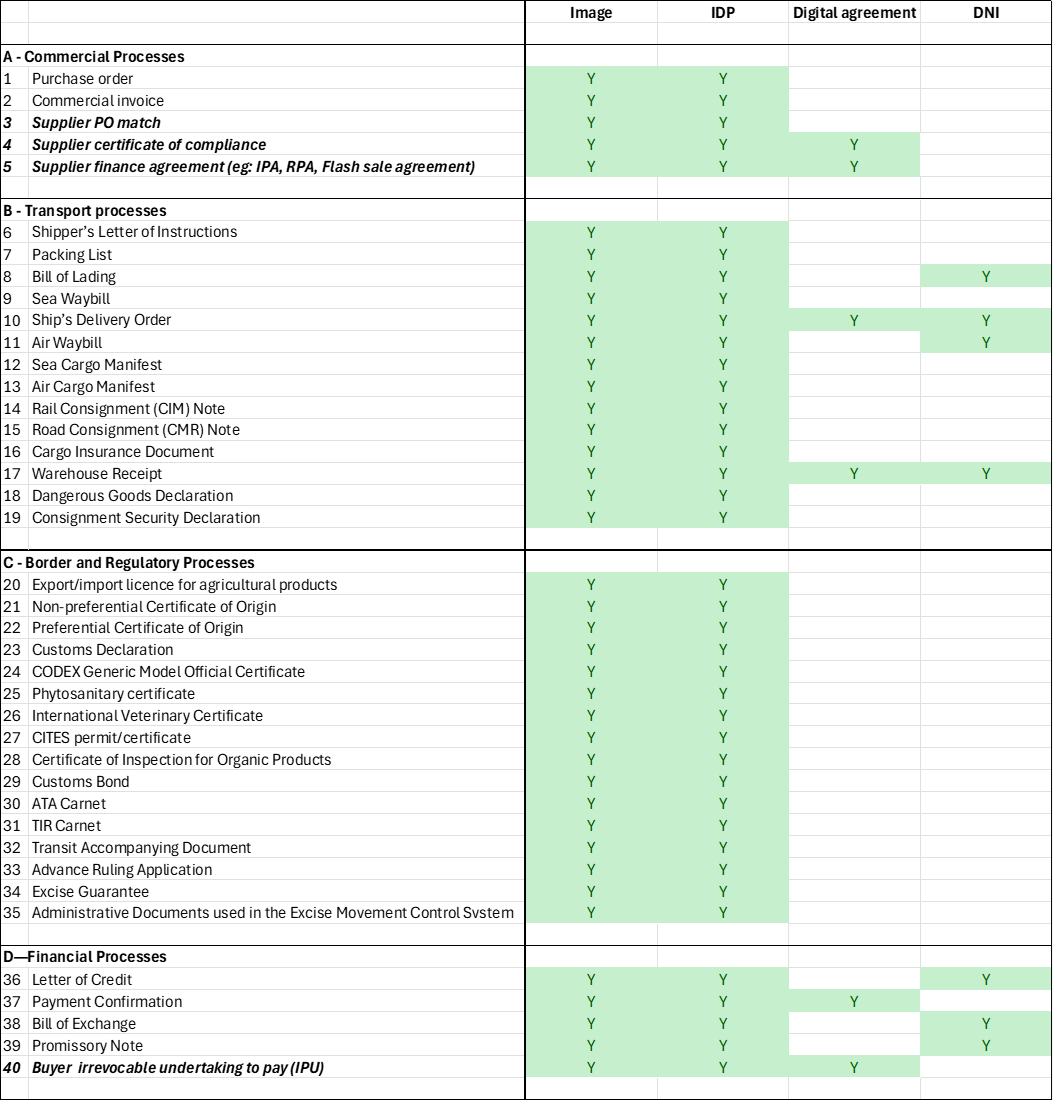

Mapping the DSI documents onto the manufacturing supply chains that we support suggests that 4 additional documents should be added to the list.

These documents, alongside the DSI list, enable high levels of automation, low cost trade finance, instant payments to suppliers and big savings for corporate buyers in manufacturing supply chains - powered by our "cash against data" technology.

In section A of the DSI table, "commercial processes":

Supplier PO match: the supplier reconciles the contents of the shipment back to purchase orders it has been awarded by its customer (the buyer)

Supplier certificate of compliance: the supplier formally warrants that the documents and data provided by it truthfully match its supply of goods and/or services to its customer (the buyer)

Supplier finance agreement: the supplier offers (and sometimes contracts) with a 3rd party financier to sell its invoice or the goods to receive cash upfront, transferring its payment rights to that financier.

In section D of the DSI table, "financial processes":

Buyer irrevocable payment undertaking: the buyer confirms and agrees it will pay some or all of the amount of certain invoices issued by a supplier, without deduction, on or before their due dates for payment, often naming a financier. In international factoring this can be called a "verification letter".

How to digitize documents in trade?

We identify four different digitization strategies for the documents involved in trade and related trade finance activities. The detail on this topic is for another blog post.

In summary, there are four levels:

Image: a simple scan of a document or a photo of a document

OCR & IDP: intelligent document processing to extract data from scanned paper documents and organise the data so that it becomes useful

Digital agreement: where electronic contracts are created and electronically signed

DNI: where digital negotiable instruments are created and executed electronically which can be transferred independently between 3rd parties without paperwork

The right digitization strategy for a given document depends on its use, context and role in the trade and in any trade finance involved.

Mapping documents to digitization strategies

The table below takes the documents from the DSI report, plus our additional four documents, and maps them against the available digitization strategies. Here we show which documents can usefully be digitized by which method.

What digitization strategy is best?

Digitalization of trade and digitization of documents are going to happen as the benefits are significant.

In the physical supply chain, all transactions can benefit from using electronic documents of carriage - eg: an electronic bill of lading rather than a paper one.

For most corporates (buyers and suppliers) this is not a decision for them - but for the carriers, forwarders and transportation specailists involved in the carriage and landing of goods.

In the financial supply chain, the digitization strategy depends on context.

This is an area where corporates can drive strategy and directly benefit:

Trade in commodities typically involves 3rd parties engaging from a distance and financiers usually take security over cargo in transit. Here DNIs, particularly the e-bill of lading, are significantly more efficient and safer than legacy paper-based approaches.

Trade in manufactured goods (like food, FMCG, components) is usually bilateral between buyers and suppliers with financing provided directly to either the buyer or the supplier to the trade. So DNIs generally do not add much value to the financing because everyone involved is present.

OCR/IDP can convert paper documents to organised data in order to obtain a useful digital version of all the trade documents - leading to automation and efficiency for everyone involved.

For financing, agreements can usually be done bilaterally, automatically and online (so no need for DNI, digital agreements are sufficient).

PrimaTrade's clients are typically saving 1% or more on the cost of goods because digital financing processes can deliver instant approvals from buyers and instant payments to suppliers.

There is no time to wait. Digitize now - real benefits - proven technologies.

Click here to get in touch.