Two tier supply chain finance

There has been plenty of industry talk of "deep-tier" supply chain finance.

There has been publicity about a number of Chinese platforms that enable "vouchers" from an "anchor buyer" to be split and traded down the supply chain.

See more here and here, for example - although these announcements are 4 or 5 years' old now. But in the rest of the world, there does not seem to have been any substantial progress.

But actually, could two tiers be all we practically need?

Two-tier supply chain finance means that liquidity support reaches immediate suppliers (the first tier) and also to their direct suppliers (the second tier).

There are corporate buyers for whom a two tier approach can be very sensible - and it is much easier to realise than deep-tier. There are real benefits for both buyers and suppliers; two-tier SCF is practical to realise and simple to set up.

Read on:

What is two-tier SCF?

The business case for two-tier supply chain finance?

How do we make two-tier SCF work in practice?

Structuring points to consider

What is two-tier supply chain finance?

SCF, or supply chain finance, is a system enabling suppliers to get paid their invoices quickly. It helps suppliers because they have less risk and they have less waiting time on payments; it helps buyers because the payment to the supplier is usually made by a 3rd party financier (eg: a bank), enabling buyers to still to enjoy the original payment terms themselves. It is a win-win.

Two-tier SCF is when the SCF program is extended two levels down the supply chain - to both first and second tier suppliers.

First tier suppliers are those who contract with and supply directly to the corporate buyer. Second tier suppliers supply the first tier supplier. See the examples coming up.

The business case for two tier SCF

Here are two real-world examples from US/European markets where two tier SCF makes sense:

The corporate buyer is a large supermarket, and its fresh produce counters are supplied by farmers. There is a lot of government and public pressure to make sure that farmers are paid quickly, but there is a middle layer of wholesalers, packagers, processors and cooperatives in between the supermarket and the farms.

The corporate buyer is a garment retailer, and it sources garments from factories in Turkey. The Turkish factories, in turn, are supplied by fabric mills in South Asia (eg: India). But liquidity stresses on the factories and the buyer's desire to control the manufacturing inputs mean that the buyer wants to source and pay for the fabric, even though it is being supplied to the factory and not to itself.

In both cases, the corporate buyer would like the supply chain finance program to go down to the second tier supplier.

Then the second tier supplier can also be paid quickly by a financier relying on an assurance from the anchor buyer at the top of the supply chain - perhaps even with the second tier supplier agreeing an early payment discount that can flow through the supply chain resulting in cheaper goods at the top.

How do we make this work?

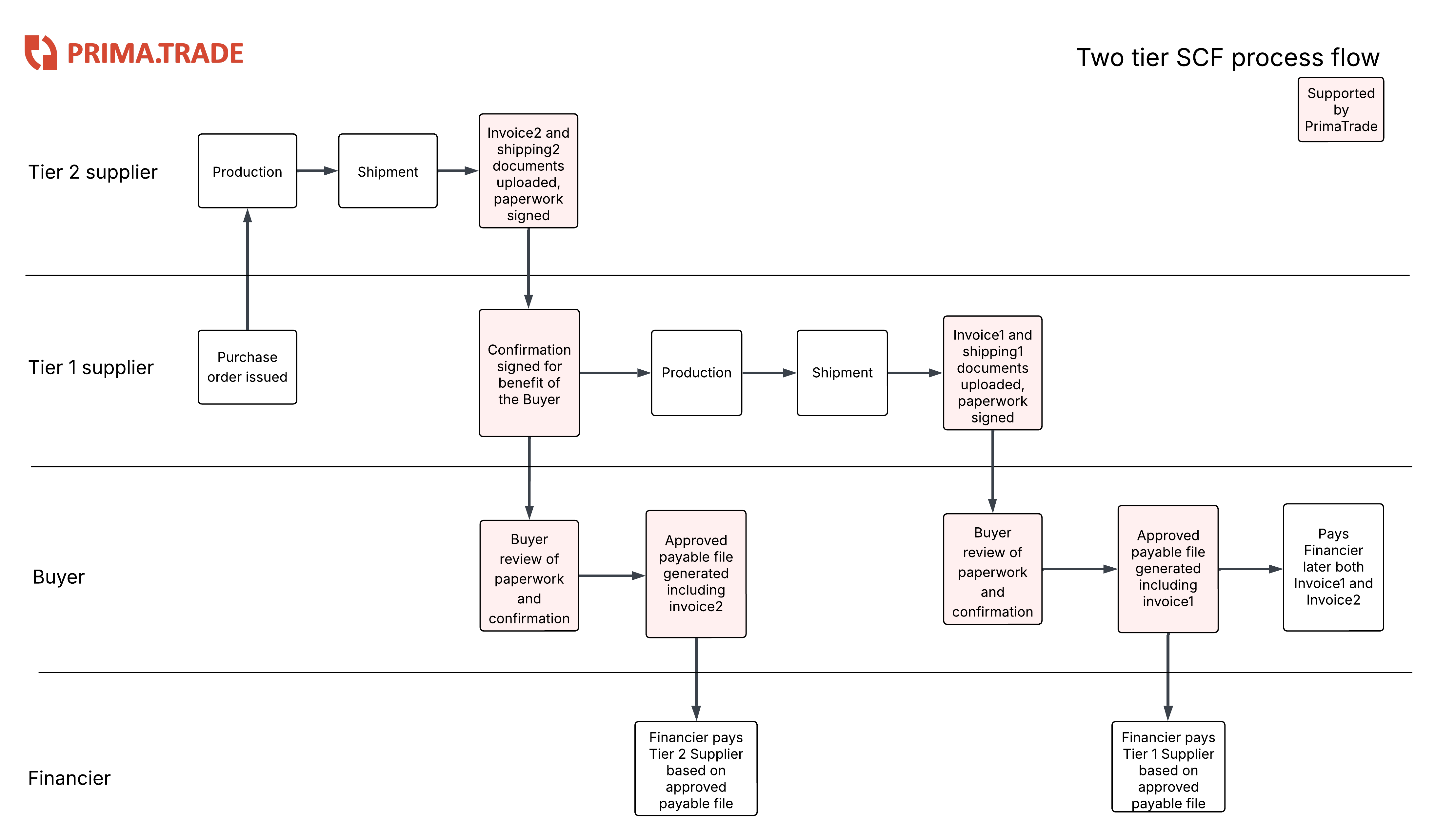

In line with the ADB and BAFT principles for deep-tier supply chain finance, we want to make sure the finance provided to both tier 1 and tier 2 suppliers is supported by a clear confirmation from the corporate buyer at the top of the supply chain (the "anchor buyer") that the invoices involved will be paid.

See the ADB/BAFT guidance here. So this is the starting point. See also our comments on the guidance here.

Our clients, typically, are not comfortable issuing blanket payment guarantees ("vouchers") that can be split and traded down a supply chain, so the "Chinese model" referenced above is not one that is going to work with them.

Our clients, the anchor buyers in the supply chains, want us to collect enough evidence of the supply between the tier 2 supplier and the tier 1 supplier each time and before any assurance is given to a financier that can be used to support a payment.

This may not be just a matter of risk - it can go to the heart of the accounting analysis as well.

This is easy to do using the new breed of digital SCF platform, like PrimaTrade.

We add both suppliers to the PrimaTrade platform.

When the tier 2 supplier ships, it uploads its paperwork (transport documents, packing lists, invoices, purchase orders, inspection reports) and converts it to data which can then be used to validate its supply to the tier 1 supplier. This enables the anchor corporate buyer confidently and justifiably to provide an assurance to a financier, who can then pay the tier 2 supplier directly.

Later, when the tier 1 supplier ships, its invoice should be net of the payment already made to the tier 2 supplier. This needs to be checked, but because the SCF platform sees both trades (and their invoices), this check is fully visible on the platform.

In turn, when it ships, the tier 1 supplier uploads its paperwork and converts it to data. This enables the tier 1 supplier to access supply chain finance as well - with the buyer finally settling both positions (tier 1 and tier 2) with the financier after an agreed credit period.

Two tier supply chain finance: process flow

Supporting these arrangements is a native capabilty of a digital SCF platform; the platform is naturally powered by supplier data rather than data from the buyer's ERP. The key point here is that it may be difficult to set up the anchor buyer's ERP to track both tier 2 and tier 1 activities - so platforms that rely on ERP data can find this process difficult to support.

Two tier SCF - structuring questions

There are some matters to think about when putting together a two-tier SCF structure.

The most important point is that the buyer typically needs to see justifiable hard evidence that the tier 2 supply has occured before providing an assurance - and may not be happy simply to trust the tier 1 supplier. This can be addressed by having the tier 2 supplier upload and digitize its paperwork on the platform.

With that point covered, there are further more detailed considerations to work through. Here are a few points:

There should be a sufficient rationale for the buyer to provide an assurance in relation to the tier 2 invoice that is compatible with the accounting treatment the buyer is seeking (ie: why is the buyer providing this assurance?).

Arranging the payment timings so that, ideally, both tier 1 invoice and tier 2 invoice can be paid at the same time by the buyer, without again compromising on the accounting treatment the buyer is seeking.

Getting the paperwork right, especially if early payment discounts between tier 2 and tier 1 suppliers should flow through to benefit the buyer.

There are other accounting and structuring questions, but these are the main ones that we have seen - and there are some good approaches that we can recommend.

Two tier SCF - is it going to be big?

There is demand for two tier SCF.

This is a specific product needed in specific situations - rather than a mass-market solution for everyone.

How do I find out more?

If you are a financier (eg: a bank) or a corporate buyer - and you would like to know about two tier supply chain finance - then please get in touch with us.

You can reach us here:

In deep tier SCF, maybe:

Two is enough, three (or more) is a crowd