Deep tier supply chain finance

Deep tier supply chain finance ("DTSCF") is topical. The ADB and BAFT have just published a joint white paper on the topic (see here and here).

Prima's platform enables DTSCF practically, efficiently and at scale. Our approach is aligned with the principles of the ADB and BAFT model - but simpler to implement and less risky for the anchor buyer.

We explain more below. This is a longer post (8 minutes read) - but deep tier supply chain finance is a more involved topic than most.

For corporates, deep tier supply chain finance generates savings, improves supply chain resilience and enhances both visibility and control.

DTSCF is coming - here's how to do it!

Cash against data - delivering deep tier supply chain finance

Deep tier supply chain finance: not difficult

PrimaTrade's digitisation platform provides the tools that are needed by corporate buyers to extend supply chain finance ("SCF") safely through to second tier and deeper tier suppliers - delivering DTSCF.

Contact us here to find out more.

This post explains:

How deep tier supply chain finance works

Our practical implementation approach

How to start

A few definitions

Deep tier supply chain finance ("DTSCF") means enabling suppliers that are below the immediate suppliers to a corporate buyer to access trade finance or supply chain finance.

The physical supply chain has tiers with the immediate suppliers being tier 1 and their suppliers being tier 2, and the suppliers to the tier 2 suppliers being tier 3 etc.

For example, the t-shirt is ordered from a garment factory (tier 1) which buys fabric from a mill (tier 2) which buys cotton from a grower (tier 3).

Tier 2 suppliers and below are the "deep tier suppliers".

At the top of the supply chain we have a corporate buyer; matching the ADB/BAFT terminology, this is the "anchor buyer".

Just like regular supply chain finance, cash will only be available to any supplier at any level in the supply chain when the anchor buyer at the top agrees that the supplier should be paid and issues an irrevocable payment undertaking or "IPU" that covers the sums owed to it.

An IPU, issued by the anchor buyer, relates to an invoice and says that the anchor buyer will pay the invoice (or an amount in respect to the invoice) without deductions or counter-claims.

An important principle

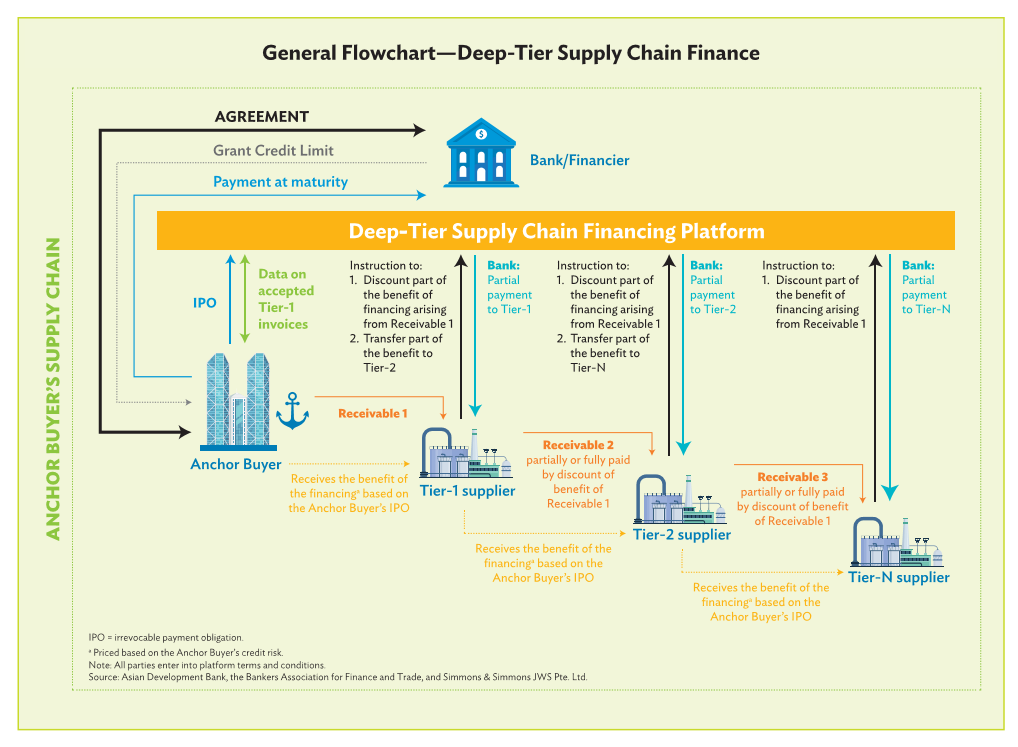

A key principle set out by the ADB/BAFT team is that finance reaching suppliers that are in deeper tiers (below the immediate supplier) should be fully supported by the credit of the anchor buyer at the top.

They draw a distinction between financing structures where each tier in the supply chain is only supported by the credit of its immediate next level - implying that the cost of funding and the quality of the credit would likely deteriorate the lower in the supply chain you go.

The ADB/BAFT principle is that the anchor buyer must support finance for all the tiers were it is offered.

Both approaches set out here (a single IPU upfront or multiple IPUs as you go) meet this principle in full - see further below.

How does deep tier supply chain finance work?

Supply chains are reasonably simple:

orders flow down the supply chain

goods flow up the supply chain

invoices are issued up the supply chain

cash flows down the supply chain

Each transaction between each tier of suppliers involves all four flows: order, goods, invoice, cash.

In a deep tier supply chain finance model, we need to add an IPU from the anchor buyer to these four steps so that a financier can be brought in to pay cash to the supplier as it completes its tasks, getting paid back by the anchor buyer later.

The IPU is the essential step

So the process becomes:

orders flow down the supply chain

goods flow up the supply chain

invoices are issued up the supply chain

IPU (from the anchor buyer) is available to the financier who pays the supplier against the invoice

anchor buyer pays the financier later

We need a practical way to enable the anchor buyer to issue an IPU that allows financiers to pay suppliers as goods travel up the supply chain.

Two IPU strategies are available

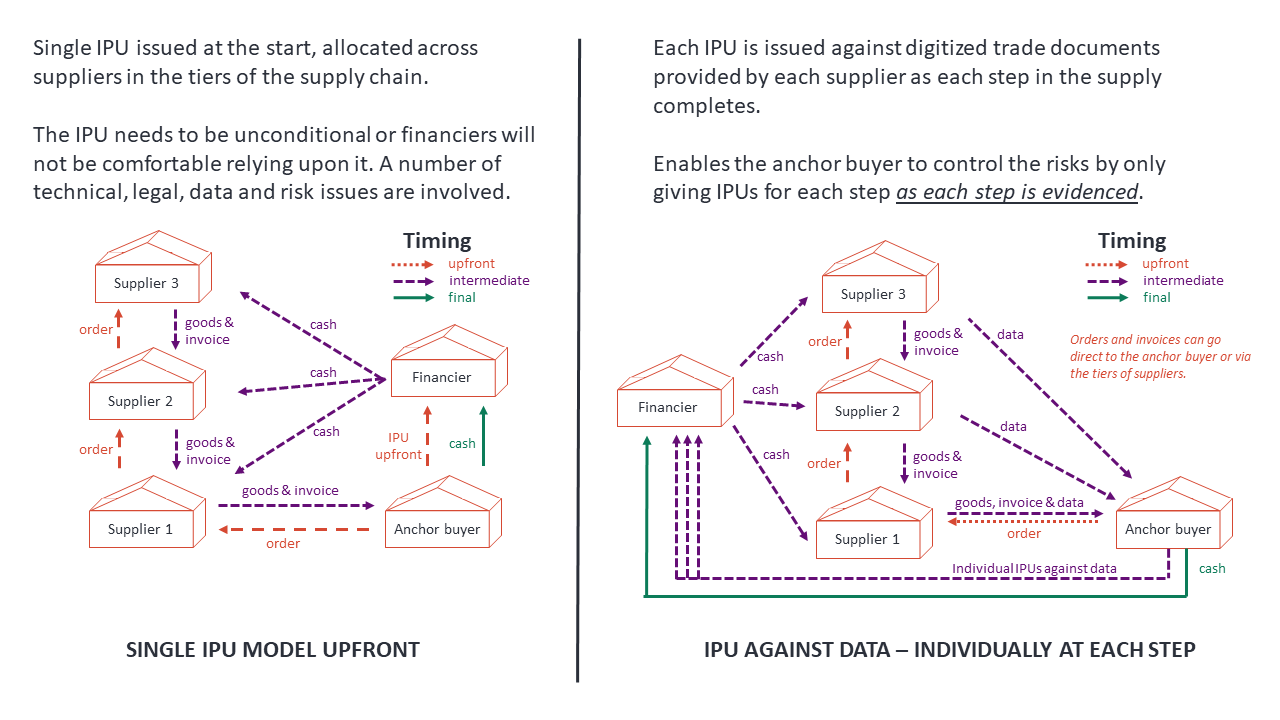

There are two ways that the anchor buyer could issue an IPU:

EITHER: the anchor buyer issues one big IPU at the very beginning (effectively in advance) that covers all the steps that will be involved in the supply chain

OR: The anchor buyer issues individual smaller IPUs against each individual step as that step completes along the way.

From a financing perspective, what matters is that the IPU is available to the financier at the time when each supplier needs to be paid.

The single IPU approach (one IPU at the start)

In the ADB/BAFT paper, they envisage a single IPU being issued by the anchor buyer in advance and before goods are flowing up the supply chain - effectively a form of "pre-shipment finance".

A single IPU issued upfront is a payment guarantee in advance of performance by the tier 1 and lower tier suppliers involved.

This means that the anchor buyer must be ready to take the performance risks involved in a series of future steps by suppliers managed by its suppliers - and to take those risks effectively on trust. This is a big ask.

There is also a range of legal issues and technical issues mentioned by the BAFT/ADB paper in the appendices related to how the single IPU can be allocated across individual steps in the supply chain.

Here is a diagram from the ADB/BAFT paper which shows the approach:

Deep tier supply chain finance: source ADB/BAFT

The Prima approach: IPUs as we go

The better approach is to issue IPUs as goods progress through the supply chain.

This is lower risk for the anchor buyer since each IPU is only issued when there is evidence that the applicable step in the supply chain has completed.

It is also practical if the right platform is employed.

Moreover, the many technical issues involved in the single IPU approach (set out in the appendices to the ADB/BAFT paper) are also resolved or avoided when individual IPUs are issued for each step.

The second way is

for the anchor buyer to issue an individual IPU in respect of each step in the supply chain as it completes

Deep tier supply chain finance - IPUs as we go

PrimaTrade: "cash against data"

The PrimaTrade platform digitizes trades, manages the creation of IPUs, and so enables cash that flows to suppliers to be matched by data that flows from suppliers.

This is "cash against data".

All the suppliers who should benefit from DTSCF (tier 1, tier 2, tier 3 etc) go onto the Prima platform.

Each time a supplier ships on the Prima platform it:

Uploads its paperwork (transport documents, invoices, packing lists, ESG documents)

Digitizes this paperwork itself, warranting the data

Matches the invoices issued to purchase orders

And the paperwork, data and PO match are instantly visible to the anchor buyer

The PrimaTrade platform performs the following tasks:

track the purchase orders going down the supply chain,

track goods coming up the supply chain via digitized trade documents,

issue the IPUs backed by the anchor buyer for each individual supply (helping the anchor buyer to manage the risk by confirming trade paperwork and matching the purchase order at each step)

draw finance to get suppliers paid against the IPUs

allocate the final payment from the anchor buyer back to the financier(s) involved across the tiers

This individual IPU model is much safer for the anchor buyer and has less legal and technical complexity for financiers.

Who orders, who invoices?

The individual IPU approach ("cash against data") can support three models:

direct orders and invoicing between lower tier suppliers and the anchor buyer (tier 2 supplier invoices the anchor buyer);

an alternative where orders and invoices go from one tier to the next for each step (tier 2 supplier invoices the tier 1 supplier); and

flash title, where tier 2 supplier invoices and sells the goods to the anchor buyer who then re-sells the goods instantly to the tier 1 supplier (netting the sale invoice to the tier 1 supplier against the final invoice the tier 1 supplier will later issue for the goods).

Likely the best model is where orders and invoices are with the anchor buyer directly because this makes it easier to justify (for accounting reasons) why the anchor buyer is issuing an IPU.

The flash title model (3 in the above list) is very powerful because it enables the anchor buyer to manage working capital dynamically down the supply chain based on supplier need and supplier appetites to agree discounts.

The "direct-to-anchor-buyer" model (either 1 or 3 in the list) also reflects how many buyers already work today.

Anchor buyers are becoming increasingly interested in the deeper tiers of their supply chains, how goods are sourced and what materials and components are ending up in the products that they buy.

This more scrutinised approach to the supply chain is being driven by ESG and modern slavery legislation and tighter regulations being enforced at customs and border controls.

An example DTSCF trade

The anchor buyer orders t-shirts from a garment factory (tier 1) to be made with fabric supplied by a cotton mill (tier 2) using cotton from an approved grower (tier 3).

The anchor buyer places an order to the factory for the t-shirts and an order to the cotton mill for the fabric and an order to the grower for the cotton. Those purchase orders are placed by the anchor buyer and uploaded to the PrimaTrade platform.

So, in our example:

the cotton grower ships cotton to the mill, evidences its shipment on the Prima platform by digitising its paperwork and matching the order, issues its invoice to the anchor buyer, the anchor buyer confirms and issues the IPU and the financier pays the cotton grower;

in turn, the fabric mill ships the finished fabric to the garment factory, issues its invoice to the anchor buyer, and gets paid against an IPU issued based on the evidence of its shipment matching the order on the Prima platform (net of the cost of the cotton);

in turn, the garment factory gets paid as it ships to the anchor buyer, invoices the anchor buyer, and gets paid against an IPU issued based on the evidence of its shipment matching the order on the Prima platform (net of the cost of the fabric); and

the financier gets paid back by the anchor buyer on the due date of the invoices at the end of the trade.

Early payment discounts from each tier of the supply chain can also be arranged and monetised on the PrimaTrade platform from each step in the supply chain - leaving a typical buyer with a saving of 1% or more on the cost of the goods after the cost of supplier finance is taken into account.

How deep can we go?

Theoretically the PrimaTrade platform can go as many tiers deep as anchor buyers want to support.

And clients are realising that modern ESG and compliance regulations require them to know much more about the goods that they are buying - so the mechanics involved in deep tier supply chain finance are starting to match the way that many supply chains are operating.

DTSCF can help anchor buyers to control their supply chains more effectively

We already have clients who are paying tier 2 and sometimes tier 3 suppliers in order to control the sourcing of component parts and materials into the finished goods they are buying from tier 1 suppliers.

This is going to happen more and more - and platforms like PrimaTrade can then extend regular supply chain finance down easily into the deeper tiers based on IPUs from the anchor buyer.

How do I start?

Our clients usually start with a pilot which can be set up without an initial IT project.

Our platform is available on a SaaS basis - which means that clients pay for what they use and there is no upfront licence fee. It is easy to start - just add suppliers and go.

Try us out - call us here.