Supply chain finance innovation: it's cake time

Big news.

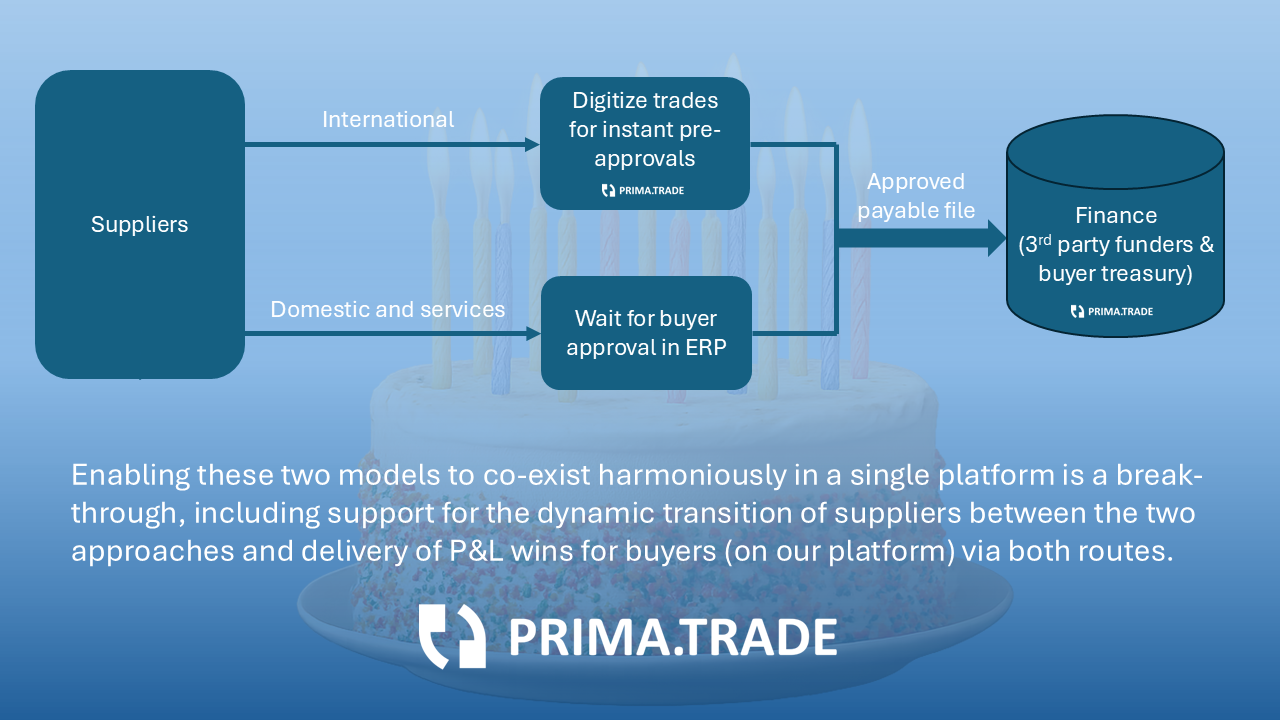

PrimaTrade's platform now supports approved payable files from buyer ERPs, concurrently with our existing supplier-driven approach.

This enables corporate buyers to use our platform with the whole of their supply chain, whether suppliers are domestic or international, delivering goods or services. All the benefits of the PrimaTrade platform are universally available - including P&L wins, dynamic management of advance rates and our true multi-funder model.

SCF: have your cake and eat it!

As many of you know, the PrimaTrade platform offers corporate buyers a new way to engage with suppliers and pre-approve invoices for early payment.

PrimaTrade delivers instant invoice pre-approvals at shipment based on supplier data rather than ERP data

This innovation has enabled our clients to save over 1% on the price of goods supplied via early payment discounts. Suppliers give big discounts when early payments are truly early - at shipment rather than after delivery.

We have now added the concurrent capability to operate supplier financing in the conventional way.

That means suppliers can also gain early payments based on invoice approvals from the buyer's general ledger (the "ERP"). Whilst these buyer approvals can take longer to arrive, there are many situations where this can be the best approach - for example, for delivery of services or where suppliers have short transit times for goods.

PrimaTrade: support for both new and legacy SCF models

Buyers can operate both approval models at the same time and dynamically.

This is delivered within one, integrated environment; some suppliers can be paid based on approved payable files from the buyer ERP whilst others are providing their documents and data to drive very early pre-approvals on our platform - coordinated with a truly multi-funder model that includes the ability to mix in the buyer's own cash.

And of course we support the migration of suppliers from one approach to the other and back again - and all without disturbing the relationship with third party funders.

It is "cake-time"!

Our platform now provides a truly comprehensive model - an "operating system" for supplier payables programs.

Why have we done this?

The PrimaTrade platform is now 3 years' old. Whilst our award-winning design is radical compared to the legacy market, the platform is now fully proven at scale with clients - already operating across 26 countries.

Like all emerging technologies, we have taken our time to listen to our clients and only to develop features that our clients actually want.

Our "supplier-data-driven" approach was developed to deliver for corporate buyers that have international supply chains and who want to offer suppliers a payment at shipment. This is a large flow globally - some US$8 trillion per year. And our unique capabilities are delivering for clients at scale.

And now our clients are asking us to take on a number of other supply chain models, such as:

domestic supply chains with short transit times,

suppliers shipping internationally but "DDP", and

suppliers who provide services.

Here the power of a supplier-data-driven model is not always the best approach.

It can be better for these kinds of supply chain to work on the conventional SCF model. Suppliers invoice the buyer, the buyer approves the invoice and updates its accounting system, and then an approved payable file is generated and processed by our platform. Once the invoice reaches our platform, suppliers can see the buyer approval and can then choose whether to take an early payment on discounting terms that are dynamically set.

Why have we done this now?

Clients are asking for both approaches to be available in one platform concurrently - and for a dynamic capability to manage how suppliers interact with early payment offers.

Concurrent support for both new and legacy SCF models

One client is one of the biggest players globally in supply chain finance. They have multiple programs and are looking for an "operating system" that allows them to manage all these programs as well as optimise and add new capabilities.

They want us to take on the existing SCF processes as they currently work - since many suppliers are providing services or are domestic. They don't want to ask suppliers to change how they work.

And then they have a large number of other suppliers that are not in the current programs because they operate with long transit times for goods and where existing approval times are too slow. These suppliers will be set up with a supplier-data-driven model to make early payments instant and attractive to them - whilst crystallising the P&L benefits that can follow for the buyer.

And of course, we need to be able to manage suppliers moving from one approach to the other, and to have the platform operate seamlessly with multiple funders, multiple documentation requirements, integrate their own surplus treasury cash when it is available - and still provide a single dashboard that oversees everything.

What about the other PrimaTrade innovations?

As you can imagine, we have implemented the ability to accept approved payable files from the buyer and still preserved the other unique options for the buyer:

True multi-funder (one supplier can access multiple funders at the same time including the buyer itself)

Integrated and dynamic use of own funds (buyer treasury funds can be seamlessly mixed in to provide early payments to any supplier any time)

Monetisation of discounts (if the discount agreed by the supplier exceeds the funding cost, the buyer makes a P&L win, all fully-managed by us)

Set your own advance rates (the amount paid early can be varied by supplier and less than the full amount of the invoice - helpful to ensure a trade payable accounting treatment)

Real-time management of debit and credit notes, and optional management by us of payments to suppliers and funders

Real-time legal agreements (via our Docusign integration, supplier paperwork is generated invoice-by-invoice in real-time)

Support for payment term extensions (electronic bills of exchange, use of payment agents)

Supply chain finance innovations: find out more

This is another major innovation for the supply chain finance market.

Buyers can support their suppliers and ensure that there is liquidity available to their supply chains using both conventional and new approaches to approvals at the same time.

Please get in touch - we would love to discuss this with you: