Supply chain finance? Definition, how it works, new developments.

Supply chain finance (definition) is a means for buyers to get their suppliers paid quickly by a third party financier. This benefits suppliers by improving their liquidity and financial strength, whilst usually also enabling buyers to lengthen their invoice payment terms. It is a win-win product.

This short post covers the basics. Advanced readers might skip to the final section ("Supply chain finance – the future") where we cover some of the new developments now available.

Below we discuss:

The basic operational model

Legal structures

Accounting and cash mangement

The problem of debit and credit notes

New developments that significantly improve SCF

Supply chain finance - is it all the same?

Supply chain finance goes by quite a few names:

SCF

Supplier finance or supplier financing

Reverse factoring

Payables finance or payables finance financing

Working capital finance or working capital financing

The names, as far as we can tell, get used interchangeably. There are differences in structures and approaches, but these are rarely reflected by the use of a specific label.

Supply chain finance (SCF): definition

This is a financial product and it does what the name suggests.

It provides “finance to the supply chain”.

The supply chain means the companies that provide the services and products which are consumed in your business – your suppliers.

The finance part means that it is a way to get suppliers paid quickly without using the buyer’s money.

The invoices that suppliers send you are the subject matter of the SCF product -also known as "payables".

Supply chain finance – why does the buyer do this?

Buyers arrange supply chain finance programs to help their suppliers with liquidity and to obtain longer payment terms.

Buyers, typically, would prefer to pay as late as possible whilst suppliers would prefer to get paid as quickly as possible.

Suppliers often find it difficult and expensive to borrow money against the invoice they have issued to the buyer. It is usually cheaper and more efficient for the buyer to get a payment to the supplier quickly.

This efficiency can translate into:

Longer invoice payment terms for the buyer; many suppliers can be willing to agree longer payment terms on invoices they issue to the buyer if they have an option to get paid quickly by a financier.

On some newer SCF platforms, direct cash savings for the buyer because quicker payments to suppliers can be economically more efficient.

Supply chain finance – basic principles

Most supply chain finance programs are arranged so that it is the supplier that borrows the finance rather than the buyer.

The basic supply chain finance process

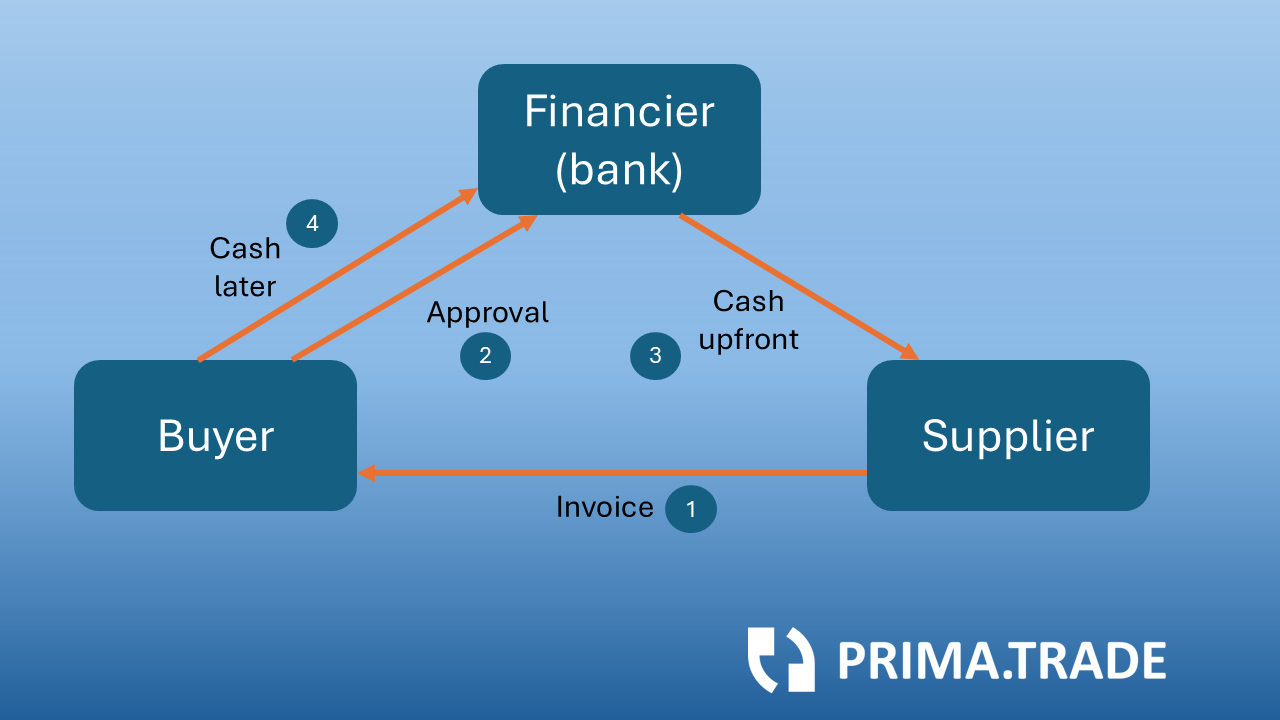

The classic model operates as follows:

Suppliers provide goods and services and invoice the buyer.

The buyer approves the invoice.

The buyer provides a confirmation to a financier that the invoice is approved.

The financier, relying on the buyer’s confirmation, offers an early payment to the supplier.

If the supplier accepts the financier’s offer, the financier pays less a discount reflecting its charges.

Later, on the invoice due date, the buyer pays the financier.

Supply chain finance – legal model

One of three legal models is typically used:

Invoice factoring: The most common approach is for the financier to buy the invoice from the supplier. The payment that the supplier receives is the purchase price for the invoice. This is also known as factoring. This also why SCF is sometimes known as “reverse factoring” – because each invoice is factored (ie: purchased) from the supplier but coordinated via the buyer.

The right to payment: Many financiers do not want to buy the invoice outright. For example, this could be because they are a bank and banks find it difficult to factor invoices for tax or regulatory reasons. In this case, the financier might just buy the “right to payment” under the invoice rather than the whole invoice.

Buyer loan: Another model that is sometimes used is the buyer loan. Here it is the buyer that borrows the money from the financier and it is used to pay the invoice early. The payment to the supplier extinguishes the invoice and when the buyer pays later, it is paying back the loan that the financier made to it. With this approach, the loan is a debt for the buyer.

Supply chain finance – platforms

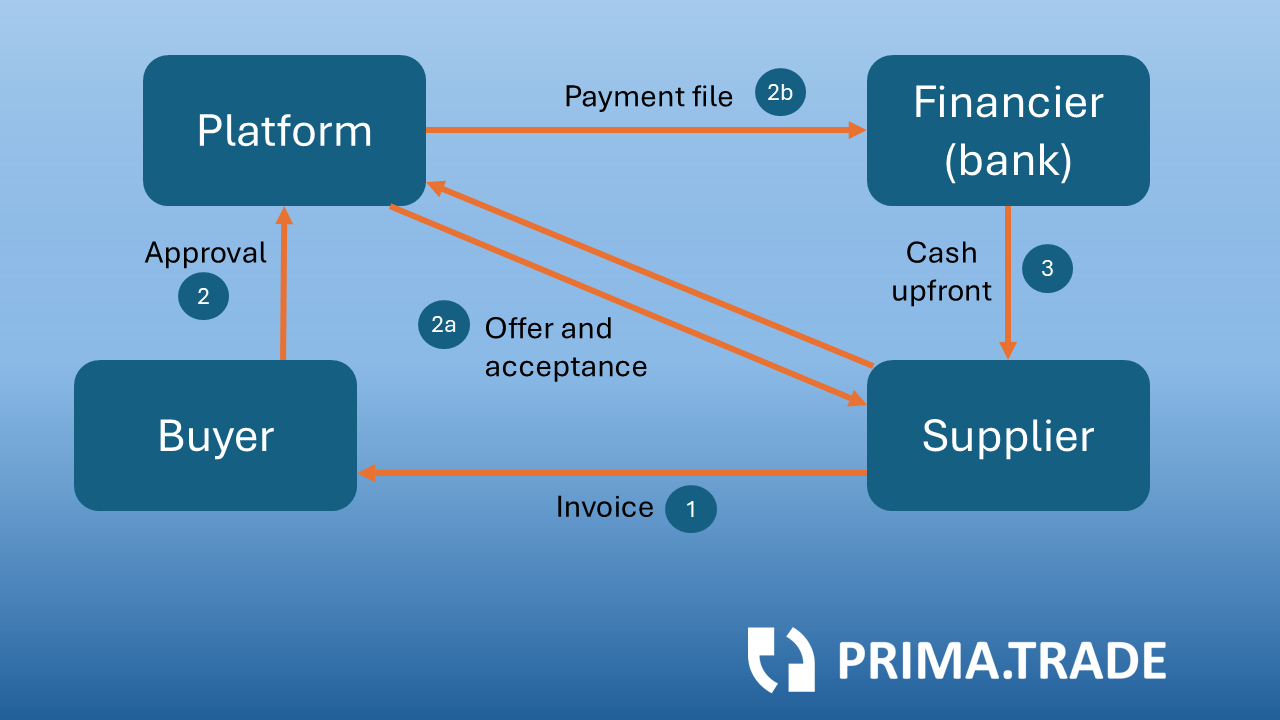

Implementing a supply chain finance program typically involves an intermediate software environment – a "supply chain finance platform”.

The platform coordinates the relationship between the buyer, the suppliers and the financier.

The role of the supply chain finance platform

The platform typically sits in between the parties.

The buyer sends the approved payable file to the platform, which brings with it the buyer’s formal guarantee that the invoice payments listed will be made in full, on time, and without cash deductions.

On receipt of the file, the platform updates the records it holds against each supplier.

Suppliers are notified that approved invoices are waiting for them, and they log into the platform and can then decide if they would like to take an early payment.

If suppliers do accept the offer, the platform then sends an instruction (a payment file) to a financier (eg: a bank) to trigger the payment to the supplier.

Buyer accounting systems – how to reflect supply chain finance

What the buyer needs to do depends, in part, on the capabilities of the platform that is being used and the legal structure.

In most cases, the operations are quite simple:

When a supplier is invited into the supply chain finance program, the account payee details for that supplier are changed and become the banking details of the financier. From this point forwards, all payments to the supplier will be routed through the financier.

When invoices are approved, the invoice is added to the file and then the supplier will take an early payment or not at its option via the platform.

On the invoice due date, the invoice is paid in the usual way but now to the financier. If the supplier was already paid, the financier keeps the money it receives; if the supplier did not take early payment, the financier pays on the cash it receives to the supplier.

Buyer accounting – claims against suppliers

It is common practice for buyers to deduct monies from invoices if there are claims against suppliers – for example, for under-shipments or faulty goods.

In this situation there will be either a debit note raised by the buyer or a credit note raised by the supplier.

Here there can be some complications for the buyer and its accounting systems because invoices, once approved, have to be paid in full to financiers. So the process of recovering debit/credit notes is often handled outside the regular accounting activity and requires suppliers manually to deduct amounts from their invoices.

In some businesses, this can be quite a tricky process and the new breed of platforms (like PrimaTrade) now offer convenient solutions (see next section).

Supply chain finance – the future

The processes described above were first implemented in platforms in about 2003. A large number of platforms emerged from this time, some developed by banks and some by software companies.

Barriers to entry are not high because the legacy platform approach is quite simple to build. But this simplicity stems from the fact that most of the tricky issues are simply thrown back to the buyer and its accounting system to deal with.

New platform designs, like PrimaTrade, address these shortcomings and provide additional and valuable capabilities:

Instant approvals: slow approvals result in early payments being not very early. Legacy platforms provide no assistance here but new platform designs now allow buyers to automate instant approvals on the platform and before their ERP gets involved.

Automated PO-matching and posting of invoices (digitized and matched by suppliers) to ERPs.

Handling debit and credit notes seamlessly so that they do not have to be processed manually or outside the platform.

Flexible funding that enables suppliers to access multiple funding programs concurrently, getting around the limitations of ERPs which typically only hold one account payee record per supplier per currency.

Mixing in own funds seamlessly, which means that, when there is spare cash, buyers can take the whole of the early payment discount for themselves.

Managing the risk of early payments by only approving part of the invoice (rather than all of it). This significantly helps to support a trade payable accounting treatment for the buyer.

Monetising the value that suppliers are getting by enabling the buyer to charge a bigger early payment discount to suppliers than the cost of the funding from the financier. This can deliver a saving of 1% or even 2% on the cost of goods.

New platforms, like PrimaTrade, are based on a new design that delivers the above and deals with the shortcomings of the original, legacy model.

Why not see the future of SCF in action?

Give us a call to see our platform or book a short demo with us: