Pricing supply chain finance

There is quite some debate on best practice when it comes to pricing the discount that suppliers might be offered for early payments on their invoices.

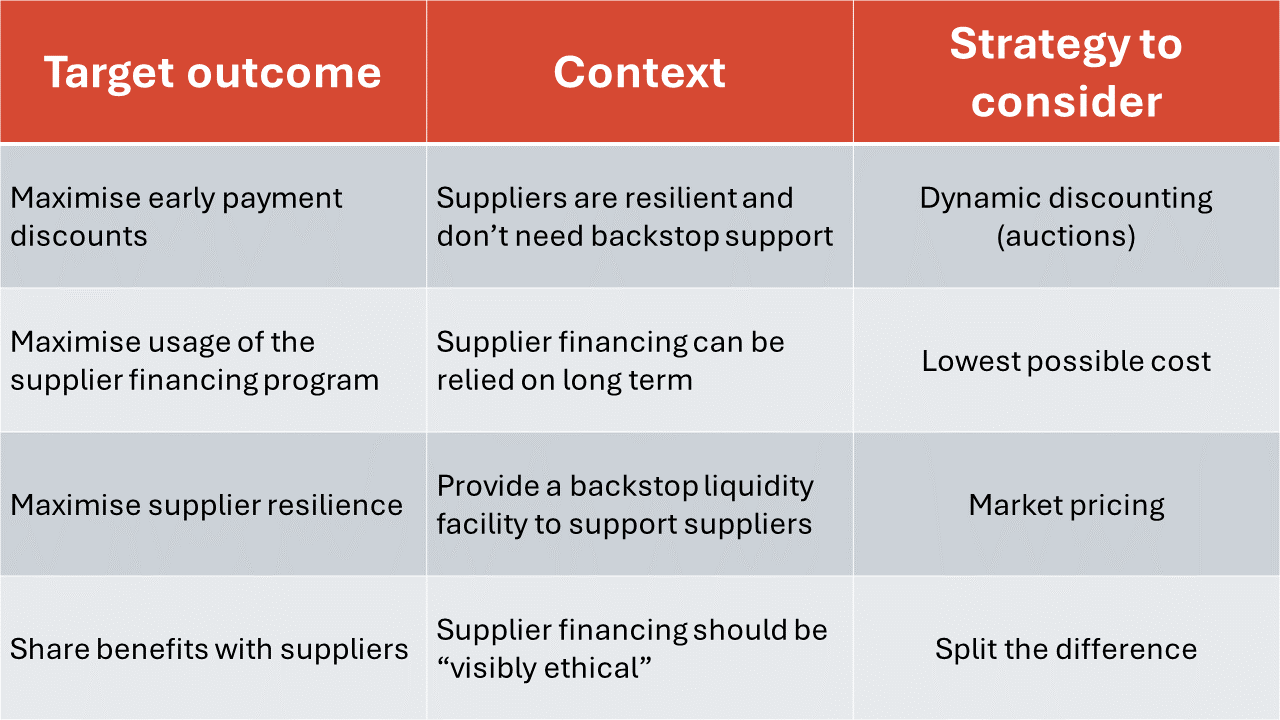

We have developed a framework that companies can use to decide how to approach the pricing of early payment options that suppliers are offered.

If you would like to jump directly to the pricing framework: click here.

The debate about pricing supplier finance spans all the flavours of program including reverse factoring, supply chain finance ("SCF") and dynamic discounting. This blog is a bit longer than usual (6 minutes) - but this is a topic that is worth exploring in some detail. For background on supply chain finance, see this article from the UK Association of Corporate Treasurers.

At PrimaTrade we provide a platform that gives buyers the maximum flexibility to manage their supply chains however they want.

The discount that suppliers can be offered for early payment can be different to the funding cost directly charged by funders. It can be varied from supplier to supplier and from time to time.

This gives new levels of flexibility to buyers and the opportunity for buyers to lock in savings on the cost of goods, including when early payments to suppliers are externally funded.

The ethical debate: "supply chain fairness"

There are several levers available to companies when they consider how to manage their days payable outstanding ("DPO").

When suppliers agree to long invoice terms, it is seemingly "free" working capital.

But buyers also need to invest in the resilience of their suppliers and so helping suppliers to access early or even instant payments (instead of waiting for the invoice due date) is a sensible approach.

There are some choices to make:

What is the right invoice term to propose to suppliers?

Should suppliers be helped with a supplier financing program, and what terms might be best to offer suppliers?

Picking an optimal invoice term is for another blog post, itself an interesting topic given existing and incoming constraints on terms, such as prompt payment codes and even binding rules (eg: EU Working Capital Directive).

For the purpose of this blog, we are focussing on the pricing question: "what discount should suppliers be offered if they access supplier finance?"

Supplier discounts for early payment

Most forms of supplier finance involve the supplier accepting a discount on the invoice that they are owed in exchange for an early or instant payment.

For example, an invoice of 100 might be due from the buyer in 90 days, and the supplier might have the option to receive 97 now rather than wait.

There can be strong views on right and wrong here.

PrimaTrade's platform offers unparalleled flexibility - buyers can choose their approach. We are aware of four potential models in the market today - and there may be more that we have not yet seen.

Pricing supply chain finance - framework

Our experience talking to CFOs and Corporate Treasurers is that there can be quite strong opinions on the best model and where ethical lines need to be drawn. And, just to emphasise again, PrimaTrade's platform supports all approaches and we are not here to judge.

Our framework is summarised here and described in more detail below.

Supply chain finance pricing framework

The four pricing models for supply chain finance

1. "Dynamic discounting": Suppliers are asked to bid for early payments which the buyer organises based on an auction. In this model, the price and availability of early payments depends on suppliers bidding against each other. This approach can maximise the dollar return to the buyer on cash that is paid to suppliers early - typically employed when the buyer uses its own funds and there is a limited amount of funds available.

But suppliers are unlikely to be able to rely on the supplier financing as it depends on their bid and how much funding is available - so they need to have fallback plans in place and be independently resilient.

2. "Lowest possible cost": Suppliers are offered the cheapest possible cost for early payments, which enables suppliers to access early payments at will and very efficiently - improving their liquidity and financial position. Moreover, some companies can sometimes take an absolute position that they should not "make money out of suppliers" and this option clearly makes sure that is not happening.

But suppliers are likely to become dependent on the supplier financing program, so it needs to be robust and confidently available long term.

3. "Market pricing": Pricing for early payments is set slightly at or above the expected "typical" cost that a supplier might incur if the supplier were to fund itself in the market and not use the program. For example, if suppliers could fund the period until the invoice due date with their own resources at a cost of 1% per month, then perhaps set the cost of early payment at 1% to 1.25% per month.

A key point here is to encourage suppliers to use their own resources to fund themselves so that they do not become dependent on the supplier financing program - but have a reliable and guaranteed offer available in case they need it.

4. "Split the difference": Pricing is set halfway between the expected cost that suppliers might incur externally not using the program, and the buyer's actual funding cost. Here the arbitrage between the lower cost of finance the buyer might enjoy and the supplier's typical higher cost of finance is shared between the two parties.

This can make sense from an ethical point of view - and the share of the efficiency gain can be set at 50:50 or any particular percentage that makes sense.

Pricing supplier finance - discussion

In the example cases below, suppliers are assumed to be providing goods and services and issuing invoices with a credit term. There is a supplier financing program available enabling suppliers to get paid more quickly with a discount.

Moreover, supplier financing is assumed to be a choice for suppliers. Ideally, suppliers should have the ability to opt in and out of supplier financing each time they supply the buyer.

What discount should apply to supplier finance?

1. Supplier resilience is not in question:

Suppliers are considered to be robust managers of their own liquidity with sufficient access to cash resources independently of any supplier finance program.

Here, dynamic discounting can make sense - since this ensures a maximum return on the accelerated payment is achieved.

Suppliers bid for the available cash and, if they bid enough, they receive cash early at the price they bid, and if they do not bid enough, they wait for payment until the invoice term, financing this period themselves.

2. Supplier financing can be relied upon long term:

Supplier financing program is a long term and structural support to the supply chain - for example, the buyer is a strong investment grade credit.

Suppliers can be offered the lowest possible cost because they can rely upon the program long term, and so can use it in place of supports they may otherwise have available in the market.

Here the supplier finance program can be made as attractive as possible since this should maximise its usage and give suppliers efficient liquidity support that can feed through to lower prices for themselves and going down through the supply chain tiers.

3. Supplier resilience should be maximised:

Suppliers should finance themselves if possible in the market using their own resources; supplier finance should be a backstop option available to suppliers if they need it.

Here market pricing should be used with the discount set at or just above the market rate that suppliers would pay if they used their own resources in the marketplace to finance the invoice term.

This means that the suppliers are encouraged to maintain their own financing capabilities independent of the supplier finance program, only resorting to the supplier finance program when they need to.

This maximises their financial independence and ensures they do not become dependent on a supplier financing program - but the program is there as an option providing them with a guaranteed liquidity line if they need it.

4. Supplier financing should, above all else, be ethical:

There is an over-riding concern on the optics and ethical positioning of any supplier financing program - for example, ensuring that there is no "making money from suppliers".

Split the difference can therefore be an option.

For example, at the buyer's funding rate it might cost a total of 1% to accelerate a payment to the supplier, whilst the supplier's marginal cost of financing the invoice term might be a discount of 3%. So split the difference and price at a 2% discount.

Is there a "goldilocks" option?

Most companies organise supplier financing programs in order to maximise the resilience of their supply chain. They can also be very conscious that it might not be healthy if suppliers become dependent on a supplier financing program, which might not always be available.

This might lead to a choice between option 3 and option 4 above - "market pricing" and "split the difference".

PrimaTrade provides buyers with absolute flexibility and the ability to run a number of pricing strategies in parallel across the supply chain - varying terms from time to time depending on utilisation, supplier feedback and market conditions.

In the end, it is up to the buyer and its financial advisers how programs are designed.