Platforms and supply chains

Supply chains and trade finance

There is a US$8 trillion gap in how supply chains are financed.

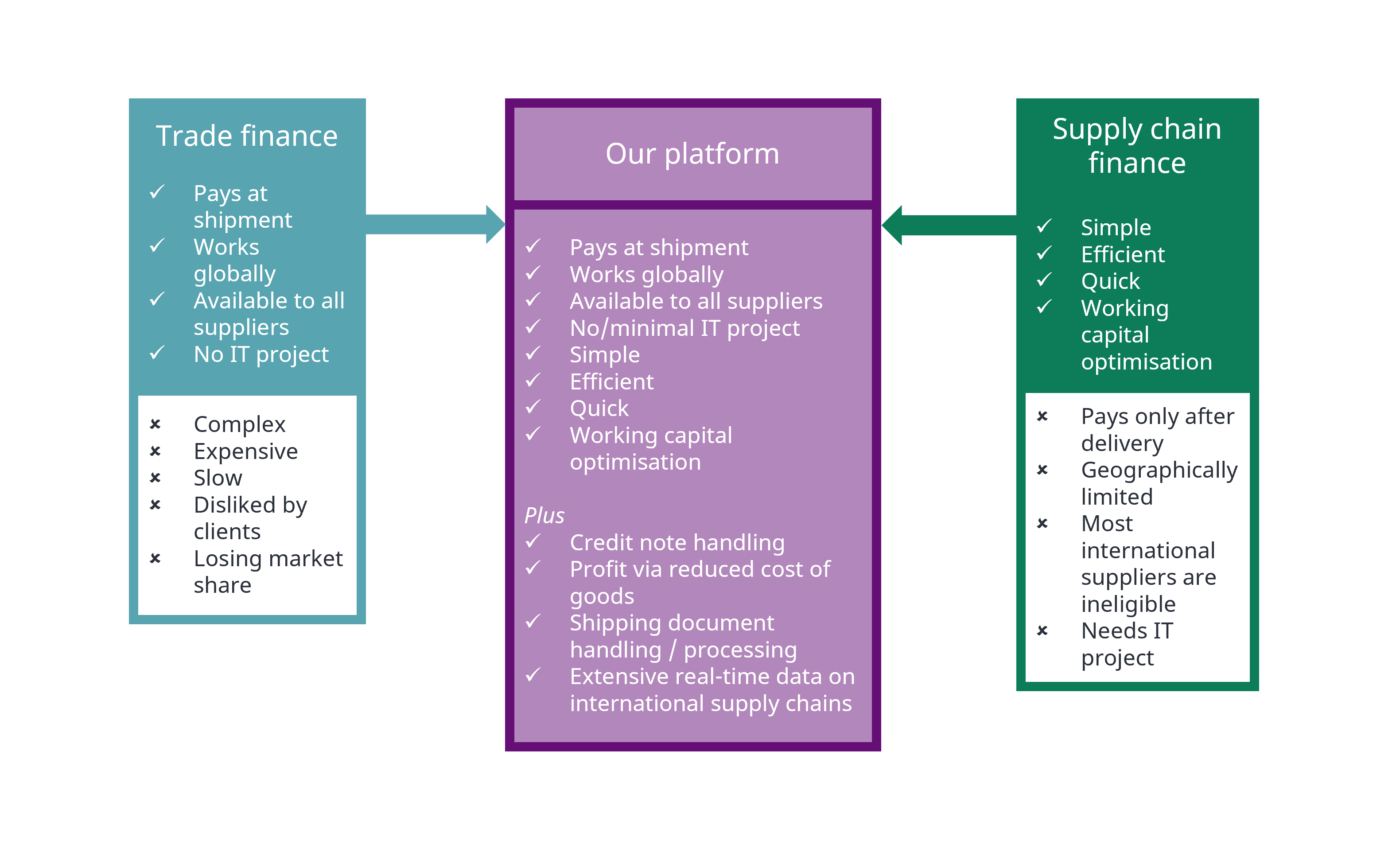

How international suppliers have been paid and financed has changed little over the years - even going back centuries. Traditional banking trade finance products have played their part, albeit with a much-declining market share in recent years, and innovations in supply chain finance have not been able to penetrate the cross-border world in any material way.

Trade finance, however it may be provided, works - and solves the collateral gap between the buyer and his exporting suppliers.

The exporter ships his goods and trade finance is used to pay him at shipment.

The buyer pays later.

This is what both parties want, and it neatly avoids the buyer-side risk of non-payment having to be priced and accepted by supplier-side funders.

But trade finance has many issues, including cost, complexity and the time it takes for trades to be processed.

Supply chain finance platforms (version 1)

It should be the answer but it is not turned out that way.

The typical operation of supply chain finance is as follows.

Eligible suppliers are moved to deferred payment terms (such as 120 days, for example), and a technology platform is implemented to connect the buyer and the eligible suppliers to one or more banks.

As suppliers deliver goods to the buyer, the goods are checked, and then invoices are approved for early payment.

On the platform, suppliers can see the invoices that get approved and request early payments; the payments are immediately made to them by the one or more banks.

The buyer then pays later, paying back the bank that made the initial payment to the supplier.

This has many advantages. It is a low cost system, scalable, simple for all parties to understand and use - it works. But it runs into many limitations.

How big is the un-funded gap in trade?

See this report from McKinsey which comments on the scale of the market that remains to be supported by efficient financing:

McKinsey Report: chapter 3 - supply chain finance

Our rough estimate based on this report is that there is some US$8 trillion in annual spend that is not efficiently supported by platforms as a result of the limitations of the existing solutions.

These limitations are summarised in this article and there are many - of which three can be highlighted:

Platforms are essential but banks find it difficult to work with platforms.

Design of the platforms and the financing structure mean that:

Banks have to on-board suppliers, so deem many suppliers to be ineligible for geographical and size reasons

No help is given to buyers who need to approve invoices before they can be paid.

Banks as software companies

A platform is needed to manage the interactions between buyer, suppliers and funders. If the platform is third party (ie: from a software company) then banks have to get happy with its operation, security, process and stability. This can take 6 months to 1 year and many banks are not able to complete this process because it requires specific skills, teams, and procedures.

In many cases this has led banks to build their own solution, and whilst some banks execute well, banks generally find software development complicated and expensive. And this also starts to limit the functionality available.

Invoice approval

Invoice approval is the biggest single issue in supply chain finance. Buyers have to approve the invoice so that suppliers can be paid. This is out of scope of traditional supply chain finance platforms - leaving suppliers often waiting weeks for buyer processes to reach a decision on an invoice.

Supplier eligibility

A second limitation is eligibility of suppliers. This is mainly driven by the compliance appetite of the banks who have to approve each supplier in the program. If the supply chain is international or involves smaller suppliers, most banks will cut them out - yet these are the suppliers most needing early payment.

Moving forward - SCF version 2!

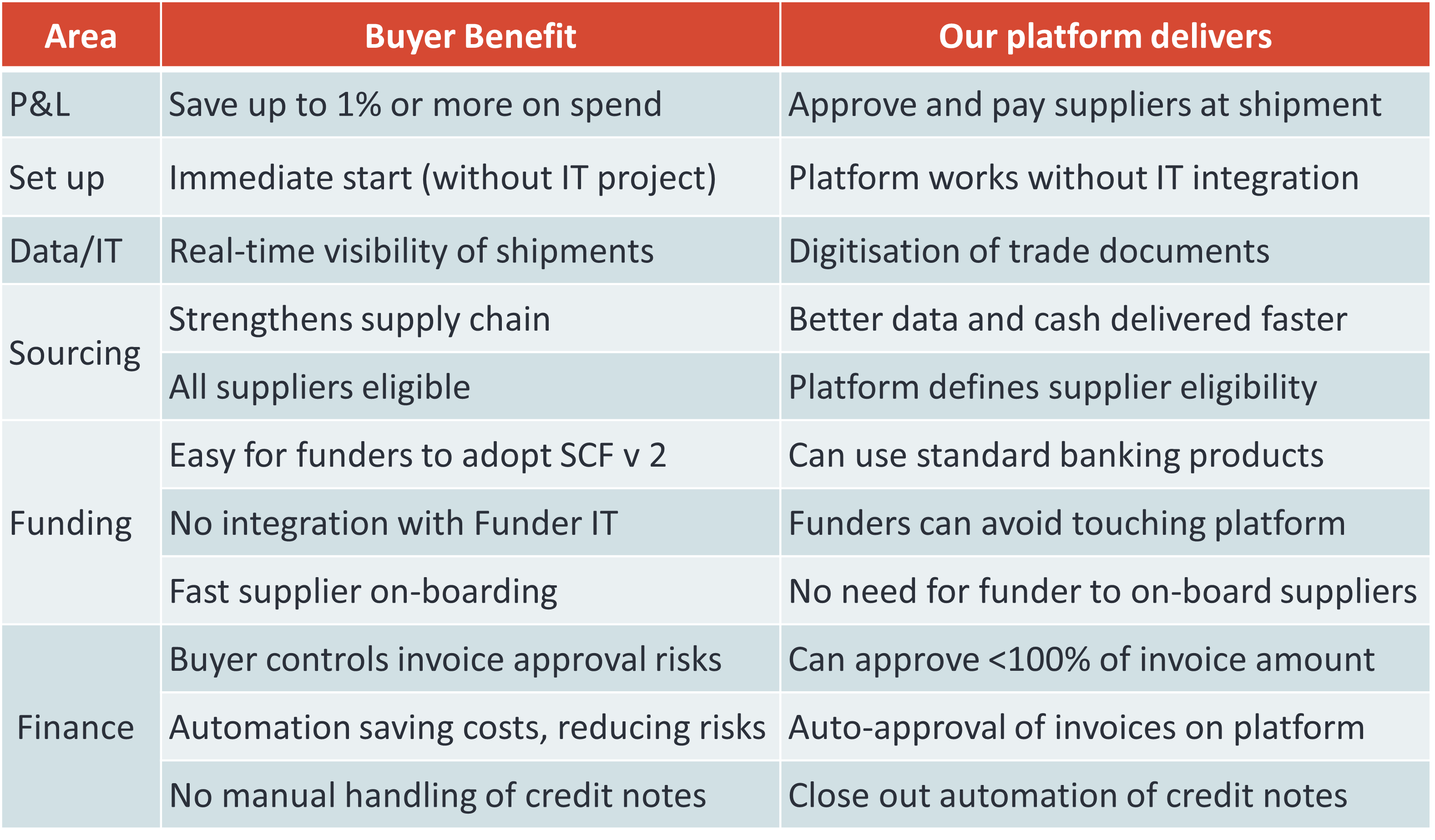

The platform that is needed solves these issues:

Automated invoice approval at shipment (so buyers do not have to do this work).

All suppliers are eligible.

Keeps banks away from suppliers so all suppliers can be eligible and banks do not have to on-board suppliers.

This next generation platform is now here - and live - and enabling finance to be provided into supply chains on a global basis. This is the www.prima.trade platform.

Our solution combines traditional trade finance (cash against documents) with the efficiencies of a supply chain finance platform:

All the benefits of both trade finance and SCF

To find out more about our platform - join our website (free) to access our detailed resources (www.prima.trade) and contact us for a demonstration / explanation (info@prima.trade).

The future of trade finance and supply chain finance platforms is here.