Optimize the benefits of SCF

Companies cooperate with SCF programs to ensure their suppliers have access to efficient cash flow support.

SCF programs can also support a buyer's working capital position and buyers can earn income from early payment discounts if SCF programs are efficient.

But there can be unwelcome impacts from SCF programs on suppliers and on buyer accounting ratios when programs are set up, changed or unwound.

If there are multiple SCF programs it can be difficult to optimize supplier access to liquidity, a key benefit of SCF, whilst also minimising the work that buyer treasury and accounting teams have to do.

When SCF programs are adjusted, this can lead potentially to:

significant impacts on suppliers; and

movements in operating cash flow and other accounting numbers.

But, the new breed of digital SCF platforms:

Enables the buyer to optimise availability of programs for its suppliers, mix in its own internal liquidity to add further support, and manage the impact of SCF on its accounting numbers

This is delivered because digital SCF platforms are dynamically multi-funder and can natively include the buyer's own cash as a funding source.

Optimize SCF to work efficiently

Dynamic management of funders (including the buyer itself) enables:

Optimal availability of funding to suppliers, including if new programs emerge or existing programs wind down

Influencing the impact of SCF on the accounting numbers, up and down

Early payment discounts to be maximised by ensuring the funding costs of early payments to suppliers are minimised

For example:

increasing buyer funding for invoices

consumes operating cash flow but

maximises the benefit of early payment discounts

whilst increasing third party funding

boosts operating cash flow but

reduces the benefit of early payment discounts

For example:

A buyer has three SCF programs that are geographically segregated:

Each supplier is only in one program based on its location.

But there are limits available in Europe and limits are full in Asia

Dynamic funding enables suppliers to be members of more than one SCF program at the same time:

Suppliers automatically access available capacity, including buyer own-funds if provided as an additional support

Usage of credit limits and internal liquidity is optimised

For example:

A new SCF lender has just been added

Instead of taking the operating cash flow benefit in one period

the benefit can be taken over time by supporting the rollout of the new SCF program with treasury liquidity

Or SCF capacity has just reduced as a lender exits

Instead of asking suppliers immediately to fund themselves or accelerating payments to reduce stress on suppliers

suppliers seamlessly access other funders and / or buyer own liquidity, managing the stress on suppliers whilst mitigating somewhat the potential impact on buyer operating cash flows

"Dynamic multi-funder SCF" - what does this mean?

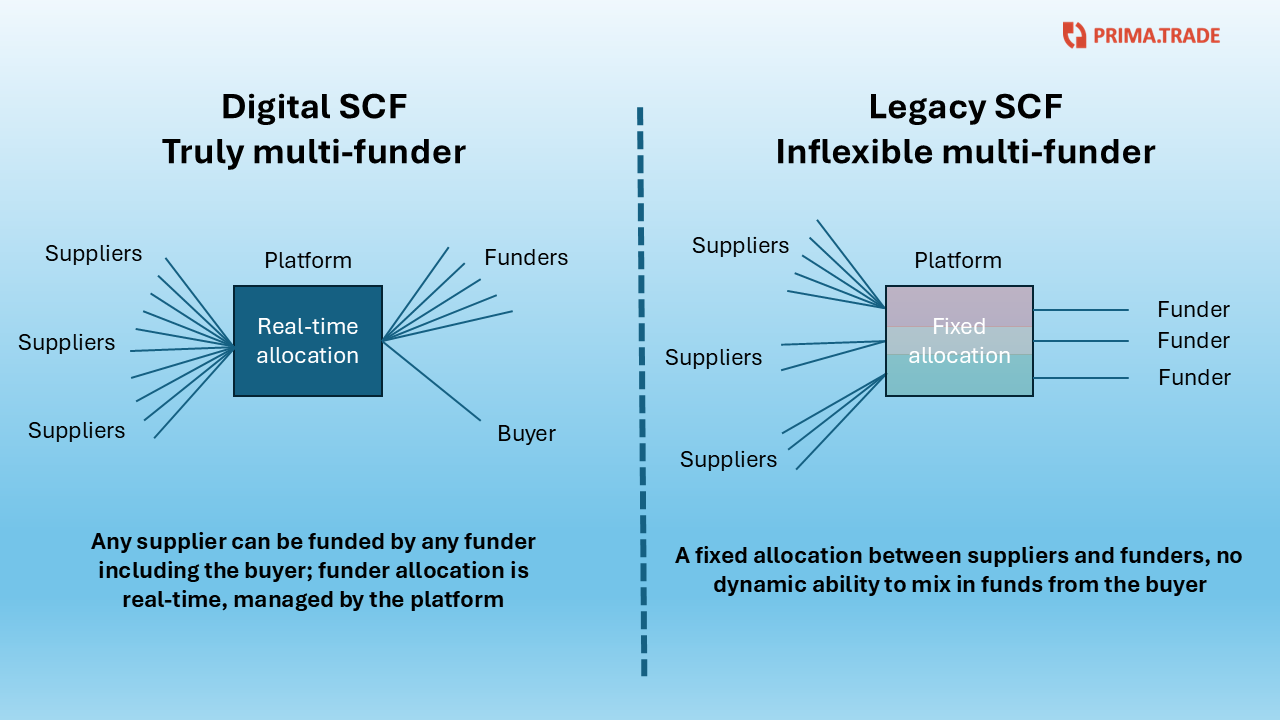

Digital SCF platforms do not "hard-code" the relationship between suppliers and funders so that:

Any supplier can seamlessly access funding from any funder (including the buyer) switching in real-time

There is total flexibility subject only to funder compliance appetite - and even there, we can provide solutions to increase flexibility.

Each time a supplier requests early payment, the platform allocates that transaction to a funder based on rules that are designed to optimise funding availability for suppliers and which can be changed periodically. The rules define the order in which available SCF limits are offered to suppliers, including the mix between buyer own cash provided to support suppliers and third party funding.

Suppliers always have a choice, shipment-by-shipment, about how to proceed, and whether not to take an early payment via the arrangements or arrange their own funding independently themselves.

Making dynamic multi-funder SCF work

The digital SCF platform enables the funding mix to be changed without inconveniencing suppliers or torturing the in-house accounts payable team.

Five capabilities are required and are built-in natively:

Limits: A dynamic limit system that manages how much can be drawn from each funding source, including from the buyer itself.

Mapping: The ability to map which suppliers can use which funding sources - noting that this is a "many-to-many" relationship. So one supplier can be mapped to multiple funding sources including the buyer itself.

Rules: An algorithm, which is easy to change, is used to determine which funding source is the one to use each time an invoice is proposed by a supplier for early payment.

Legal agreements: The ability to generate and have executed the correct agreements required by a selected funding source in flight as part of the supplier request for early payment.

Accounting and cash: And finally, the ability to manage the payments so that the right money goes to the right person and the correct postings are generated for buyer accounting.

Everyone is multi-funder, surely?

You might hear many platforms claim that they are multi-funder - and many platforms technically are. But on the other hand, you will also likely find that:

they use a fixed allocation model between suppliers and funders,

moving suppliers from one funder to another is difficult, and

buyer own-funds cannot easily be mixed in, if at all.

That means you cannot easily optimise the availability of funding capacity for your suppliers and you cannot seamlessly support programs with your own liquidity when required. It is not a flexible environment.

Digital SCF - a new standard

PrimaTrade's platform offers you a truly, dynamic multi-funder capability as described in this note, including the ability to mix in buyer own-funds flexibly across your supplier base.

Get in touch with us to discuss any aspect of this note (click here)