Fixing supply chain finance

Supply chains can be big and complicated

Fixing four big pain points in supply chain finance

So you have got a supply chain finance program – or even more than one – or you are thinking about setting one up.

You want to make sure that early payments are available to all your suppliers and you want payments to flow quickly - but your finance teams have a variety of pain points that limit what can be achieved.

Perhaps only some of your accounting systems can be connected to the SCF program – so supplier access to SCF depends on which entity they are billing.

Moreover, early is not that early. After all, finance processes are set up to approve things when they are due for payment – eg: on day 89 for a 90 day invoice. Suddenly finance teams have to think about payment approvals on day 30 or day 20 – or even on day 2; often this results in manual processes, workarounds and costs.

And then there are suppliers who want early payment sometimes, and then not others. But your ERPs only support a single set of banking details per supplier – so you end up paying your SCF funder all the money all the time, even when some of those payments should go to the supplier.

So here we have four major pain points:

Early approvals are not that early.

Not all my suppliers can be added to the program.

Not all my ERPs are linked to the platform.

And all supplier payments are blindly re-directed to my funder even if a supplier sometimes decides not to take early payment.

Perhaps all this is a surprise. The technology powering SCF is mature, advanced and highly valued. But industry surveys show that most companies want more from the SCF programs and the technology that powers them (eg: see here from the PwC working capital study 2023 - digitisation of "source to pay" is rising up the agenda for both the CFO and Corporate Treasurer).

The fact that all these issues are present in SCF programs was a surprise to us. And that’s why we are fixing supply chain finance to make it work better for everyone, delivering digitisation of the source to pay process alongside.

Fixing SCF: “extend” and “automate”

Making supply chain finance work better is surprisingly easy with the right technology.

What do we want?

Quick approvals: quick approvals lead to quick payments – ideally as suppliers ship.

Automation: so that finance teams do not have extra work to manage suppliers who are in the SCF program.

Smarter payments: so that funders only get paid the invoices that they fund.

All suppliers: and that means across the whole enterprise, no matter which entity a supplier may be billing and no matter which accounting system will process the invoice.

This can be summarised as “extend” to all suppliers and “automate” to remove the pain for finance teams.

Fixing supply chain finance is easy

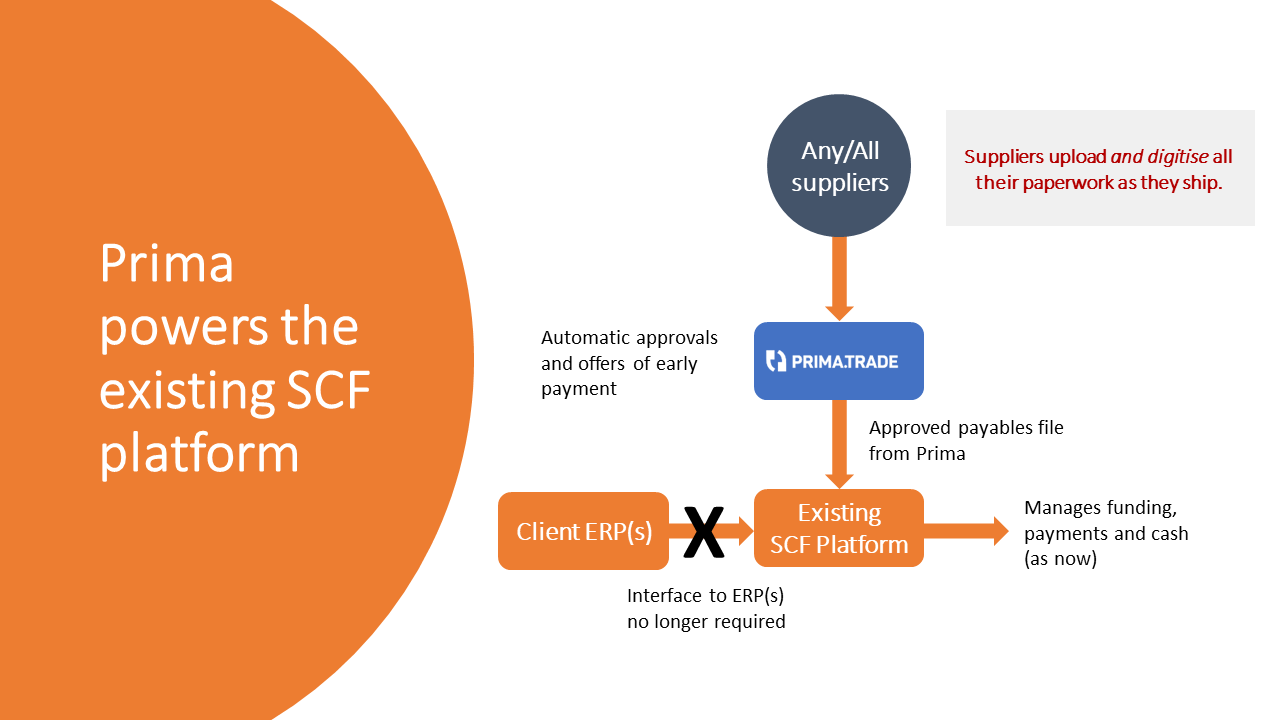

Prima’s platform can be added to your existing programs without replacing the SCF platform that you use (eg: Taulia, Prime Revenue, Demica, Kyriba, or bank-owned etc) and without changing your funders and likely without needing changes to the documentation of your SCF program.

Prima works in the background, and our platform can go live without an initial IT project. In fact, you can try us out via a pilot with some of your suppliers to test how it all works without any investment.

So what is this magic?

The magic is to power your supply chain finance process with supplier data.

This might be a new concept, but SCF programs powered by supplier data are now proven at scale and we deliver additional savings on spend of 1%+ to our clients, whilst also extending and automating their supply chain finance programs to all suppliers.

Suppliers love us – they can all have access and they get paid at shipment

Finance teams love us – their manual processes are automated

SCF platform providers love us – SCF programs become more efficient

Funders love us – SCF programs double or treble in size and clients are happy

Supplier data – the new oil

You might think that supplier data cannot be trusted, and that collecting it would be difficult.

But our technology allows you to manage how you use supplier data dynamically. Suppliers, especially in consumer goods supply chains, are actually very reliable and consistent in how they work; the suppliers are selected by you (the buyer) and perhaps they may have been supplying your business for many years.

Collecting the data is also straightforward. Suppliers ship, upload and then self-digitize all their documents. Suppliers do the work – and that’s why no initial IT project is required. Just ask suppliers to use our platform, data flows, automation results – and payments are dynamically approved as soon as suppliers can get their documents into our platform – typically within a day of shipment. See here for more information on the digitisation process.

With the trade cycle digitised, delivering SCF over the Prima platform becomes self-contained and no longer needs to reference your accounting systems.

And then your chosen SCF platform simply picks up the feed of approved payables from the Prima platform instead of from your accounting system. And since the Prima platform is powered by supplier data and sits “over the top” of your existing infrastructure, your SCF program can be easily expanded to the enterprise level.

What do I do next?

Just give the Prima technology a try – it is very easy.

There is no need for an IT project – just get in touch with us and introduce us to some of your suppliers.

We take care of the rest. Data flows, dashboards populate, you get instant transaction-level visibility into your supply chain at enterprise-level no matter the geography, product, logistics, procurement team, accounting system or subsidiary.

And then we use that data to generate the automated payables feed that your SCF platform needs – and the pain points that are holding back your SCF program are addressed.