Cash against data

“Cash against data” is a trade finance methodology that can be used efficiently to organise trade finance for supply chains of manufactured goods.

Companies that use "cash against data" technology for their financial supply chains include retailers, manufacturers, pharmaceuticals, and companies involved in FMCG.

Most clients save 1%+ on the cost of the goods that they are sourcing and generate valuable working capital and operational wins.

Trade finance can be aligned with the ICC rules for digital trade agreements (URDTT) and it can deliver significant financial savings for corporate buyers and opportunities to generate additional working capital.

Cash against data is easy to implement

Digitization at shipment enables trade finance to be provided for manufactured goods in transit and at scale, even for SME suppliers in emerging markets:

At shipment, suppliers self-digitize their transport, compliance, ESG, commercial and operational documents over a secure platform, transmitting both the scan copies and the data directly and instantly to the buyer.

Buyers are then able to give an instant approval of the invoice for early payment which financiers can then use to make instant payments to the supplier (at shipment), whilst still allowing the buyer to pay later.

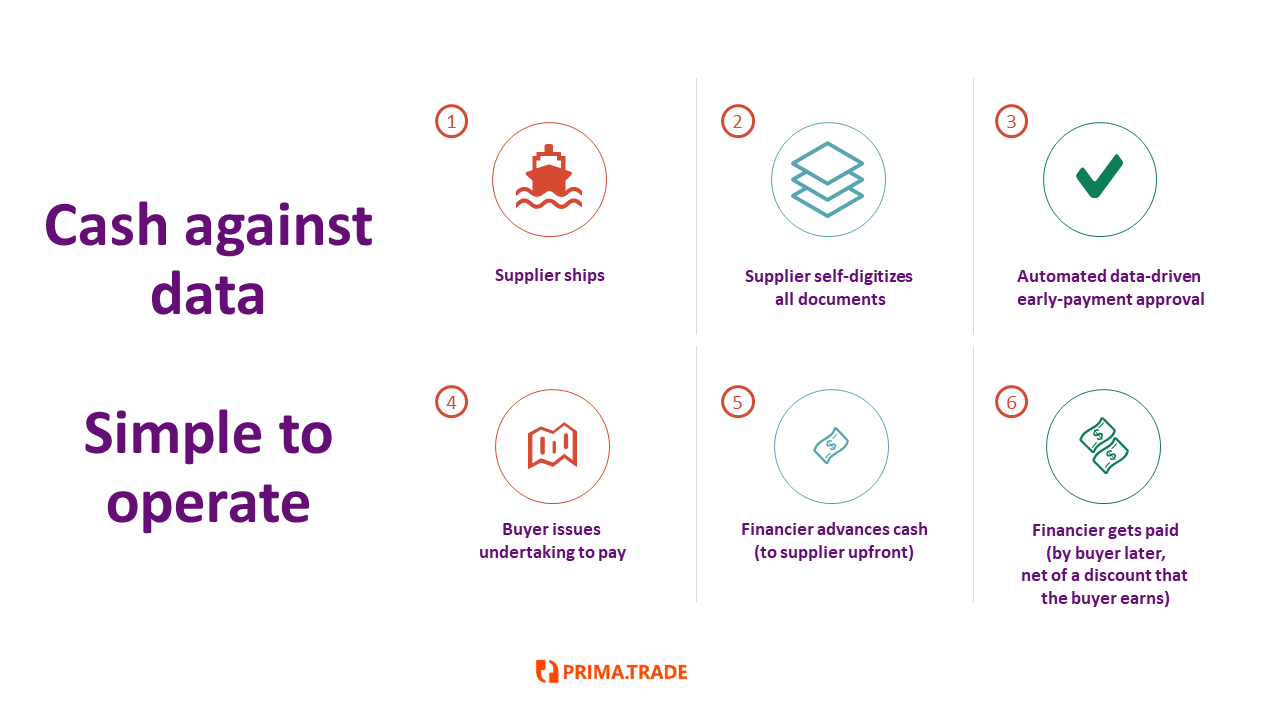

6 steps to instant trade finance and big savings

Book a call with us here to find out more: book a call. In just 30 minutes we can explain "cash against data" and show you how it works in practice.

Trade finance for manufactured goods

Digitization of the financial supply chain leads to an increase in the availability of trade finance for supply chains of manufactured goods and potentially to reduce the cost of goods directly by a material amount.

Commodities, around 1/3rd of global trade in goods: | The focus has been on the development of digital approaches to securing a financier’s claims over the goods in transit – led by the Electronic Trade Documents Act 2023 (the “ETDA”), enabling digital versions of the bill of lading, bills of exchange and promissory notes, enforceable under English law. |

Manufactured goods,around 2/3rd of global trade in goods: | Manufactured goods are usually transported by container and do not rely on financing based on controlling the goods in transit via a bill of lading. Financing for trade in manufactured goods typically relies on obtaining a commitment from the buyer to pay which can be relied upon by a financier who can then pay the supplier upfront. |

Manufactured goods include food, household products, pharmaceuticals, components, building materials, clothing, electronics, toys and furniture. Bulk commodities would include cargoes of oil, metals, grain, sugar etc.

Perhaps 90% of trade is "open account"

A lack of digitization means that most trade in manufactured goods is not financed – we estimate that 90% of trade in manufactured goods is “open account”. This means that either the buyer pays upfront or the supplier gives credit to the buyer, and there is no financing available whilst goods are in transit.

Without digitization, the buyer only gets details of what is being supplied via documentation which can take days to arrive and which is often provided to different buyer departments.

Understandably, most buyers wait until after the goods are delivered and inspected because it is onerous to try and reach a decision on an invoice before then – by which time the trade part of the supply chain process has completed.

The resulting trade finance gap is considerable and potentially a large portion of the US$2.5 trillion trade finance gap identified by the Asian Development Bank, particularly affecting SME suppliers in emerging markets.

“Cash against data” can deliver significant benefits

Cash against data will be immediately familiar as a concept to trade finance practitioners, corporate treasurers and CFOs. It is a digital version of the traditional documentary credit process of "cash against documents".

A case study of a large UK fashion business using the PrimaTrade platform that implemented a trade digitisation strategy across its entire international supply chain showed working capital efficiencies for the buyer that delivered savings of over 1% on the value of the goods being supplied as well as delivering additional working capital. This is cash against data at work and at enterprise scale.

Moreover, the digitization approach adopted was relatively quick and simple to implement, with the international supply chain moving to a fully-digital model in a matter of weeks and without a significant investment in IT.