Automating supply chain finance

Many companies offer suppliers an early payment option but are surprised that more suppliers don't take it up.

One of the big wins of PrimaTrade's "cash against data" technology is the automation of finance processes whilst delivering cash to suppliers as they ship.

With PrimaTrade, early payments are automated and truly early - leading to high utilisation and bigger discounts from suppliers.

In our implementations:

Finance loves the automation

Procurement loves the reduction in purchase cost for goods (1%+)

Treasury gains full control over working capital on the payables side

Read on for 2 more minutes.

We explain the 3-way match, why this leads to pain points for finance teams and how PrimaTrade's "cash against data" automation leads to better outcomes and a win-win for the corporate treasurer and the supply chain.

SCF programs are limited in scope

Most supply chain finance programs are limited to a few 10s or low 100s of suppliers.

Yet most companies have many many 100s (or 1000s) of suppliers.

The suppliers that really need early payments are the ones that are usually not included - smaller suppliers in more distant locations.

Automating supply chain finance: the 3-way match is the source of the pain

The finance team (or accounts payable team) decides when its okay to pay a supplier. The process to deliver the approval is usually known as the "3-way match".

The 3-way match is not compatible with supply chain finance which aims to get early payments to suppliers.

The 3-way match is a comparison of:

goods receipt to

purchase order to

invoice.

If these three items line up, the payment gets approved. If there are adverse discrepancies, debit notes are generated so that less is paid to the supplier.

Finance teams have invested heavily in technology to automate the 3-way match so that the approval process becomes virtually touchless.

But the 3-way match often occurs days (or even weeks) after goods have shipped and the invoice has been issued. It is a "post-delivery" process.

What are the finance team pain points?

There's a bunch of challenges involved in appoving early payments before the 3-way match:

Suppliers can end up being overpaid, leading to manual tracking of debit and credit notes to recover claims that arise later out of the 3-way match

It's manual work - typically involving humans checking purchase orders to shipment documents via different systems

There are back-end reconciliations with funders who inevitably get paid on invoices that they didn't finance

Most corporates decide:

to wait until after the 3-way match before offering early payments or

they take on the manual pain of trying to make it work earlier.

See our short note on why SCF is like a game of football here.

And this is why most SCF programs disappoint

Most finance teams restrict supply chain finance programs to only the largest suppliers. This leads to poor utilisation of SCF because the largest suppliers have good access to liquidity already.

Getting SCF out to the smaller suppliers is the key to getting programs working well - enhancing the resilience of the supply chain and delivering a win-win for both buyer and supplier.

Solving the finance team pain

PrimaTrade provides the finance team with a new capability, which is to deliver early payment approvals at shipment automatically.

We do this without undermining or changing the 3-way match which still runs, removing the additional manual work around payments, reconciliations and debit notes.

So that means, the finance team can be onboard with scaling SCF all the way down the supply chain, even to the smallest suppliers.

How does it work?

Suppliers, as they ship, use PrimaTrade's automated OCR systems to extract 100s of data points from their shipping documents without material effort. That's across invoices, packing lists, transport documents, inspection reports, purchase orders etc.

We use that data to automate decisions on early payments under finance team control - whether to pay early and, crucially how much to pay early (ie: it can be less than the full invoice).

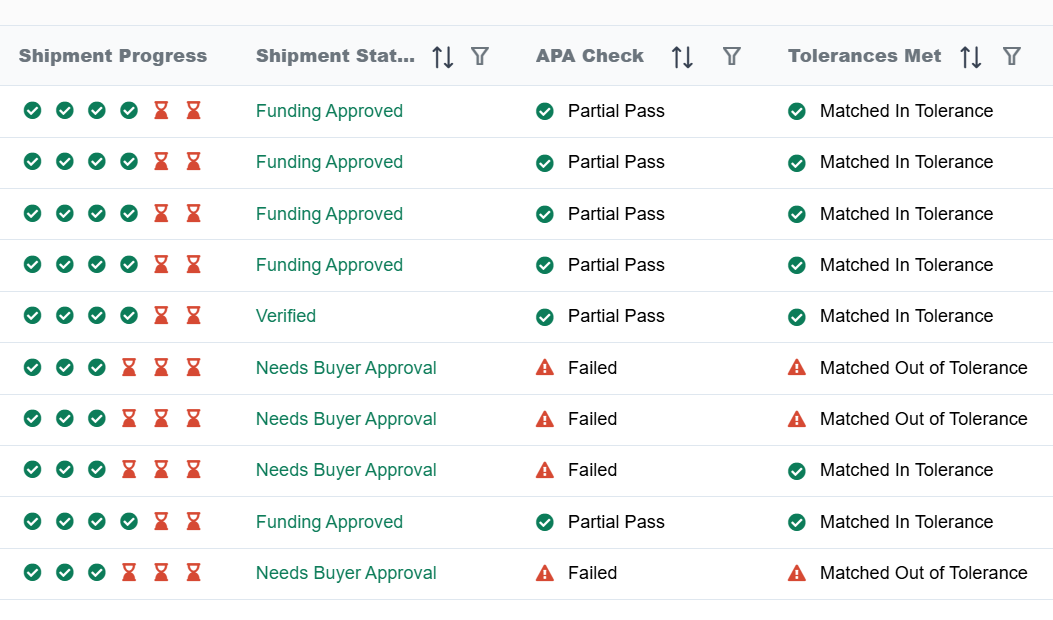

Automated purchase order matching and approvals ("APA") on the PrimaTrade platform

Paying less than the full amount of the invoice early allows room for debit notes / credit notes that might arise later from the 3-way match.

Getting cash to suppliers at shipment generates big discounts and approvals on PrimaTrade are fed into the supply chain finance program directly. The finance process is automated end-to-end, all suppliers can be included and there's no excel support required.

So early payments become touchless too?

Yes. It is an amazing outcome, and it means that supply chain finance at shipment (and before delivery) can be offered pain-free across the whole enterprise.

Corporate treasurers are able to support even the smallest and most remote suppliers with early payments, a win-win that improves resiliency and stability for the SME suppliers, whilst generating P&L and working capital wins for the enterprise.

PrimaTrade - give us a call to find out more

If you are thinking at all about your SCF program, we are happy to explain how new technology can help to upgrade your outcomes and get funding out to the smaller suppliers who really need it. Why not find out more?