SCF versus trade finance

Banks typically have a single department grouped under a title such as "Trade Finance".

But a level down, and we generally see working capital (including supply chain finance) is separated from traditional trade finance (documentary trade products). They are split and run as separate products supported by separate teams of specialists.

That's for good reason; at this operational level, each has its technical characteristics and provides different benefits to clients.

But both solutions are involved in helping businesses to pay their suppliers.

So what are the differences?

PrimaTrade's platform is the first to merge trade finance and supply chain finance ("SCF") products into a new "international supply chain finance" product.

At the end of this post, we explain how that works.

SCF versus trade finance: differences

There many differences - but here are three important ones:

SCF | Trade finance |

One bank drives the process | Two banks are involved |

Batches of shipments | One shipment at a time |

Post-delivery payment | Post-shipment payment |

The two-bank trade finance model

Trade finance is sometimes known as a "four-corner" or rectangular model. That's because both parties to the trade (importer and exporter) each have their own bank:

The goods flow between the principals (exporter to importer)

The paperwork goes between the banks (export bank to import bank)

The money goes between the banks (import bank to export bank)

So in trade finance, there are two banks. This is how the product has developed over many centuries, principally because banks can rely upon each other, even across borders and there are internationally-recognised rules for documentary collections and letters of credit (eg: URC522, UCP600).

A typical trade finance transaction involves:

A set of documentary conditions is formally stipulated by the importer and communicated through the banks to the exporter.

The exporter provides paperwork that aims to meet those conditions, providing these documents to its bank.

In turn, the exporter bank provides the documents to the importer bank which inspects them.

If the documents are compliant with the conditions or are accepted by the importer, the importer bank pays the exporter bank.

If the documents are not compliant and not accepted by the importer, the documents are returned to the exporter bank.

In this way, the standoff between importer and exporter is managed without the importer taking possession of the cargo - it is all done through the documents. If the documents are not acceptable, no cash will move and the exporter can recover the cargo.

Of course, there are many flavours of this arrangement - some of which guarantee a payment against the presentation of compliant documents - others of which simply manage the flow of documents through the trusted banking channel so that importers and exporters do not have to trust each other.

Both importer and exporter bank can combine their involvement in the process with additional services - accelerating payments or providing credit. So, in this way, importers can be given time to pay, whilst exporters can obtain cash more quickly.

And these products are decades if not centuries old, regulated by international standards, and trusted the world over.

Points to note:

Trade finance can achieve payment to exporters before delivery of the goods - in fact, that is pretty much the whole point of it.

Documents are handled via trusted banks, preventing the importer getting possession of the cargo before the exporter is assured (by its bank) of payment.

The arrangements are paper-based and operate at individual shipment level - so shipment-by-shipment.

Involving two banks means that the process is not usually very quick and there are two banks that are charging fees.

The one-bank supply chain finance model

Supply chain finance involves only one bank coordinating all the processes between a buyer and its suppliers. If this were to be trade finance, it would be similar to the "three-cornered" model or triangular approach.

But supply chain finance is rarely trade finance. Why? Because suppliers are usually only paid after delivery of goods.

How does a basic supply chain finance product work?

The buyer's bank provides a credit limit that can be used by the buyer's suppliers. It is the suppliers being financed not the buyer.

Whenever a buyer approves an invoice for payment, provided the supplier is eligible for the SCF program, the supplier can accelerate payment, drawing on the credit limit and paying for the finance.

The buyer pays later in line with the invoice terms.

So why is this not trade finance?

Buyers usually find it difficult to approve invoices before delivery. That's because their approval process is linked to the delivery of the goods, typically by matching the invoice presented to the order given to the delivery achieved. This is called a "3-way match".

Approving invoices before delivery is difficult because most finance teams do not have any data available to support a decision - accounting systems are not designed to accept shipping documents and other paperwork.

On the other hand, because there is only one bank involved, the shipping documents are ignored, and because everything is driven by the buyer's invoice approval, supply chain finance programs are easy to scale and simple to operate. Each day the buyer transmits a file of approved invoices to the bank - and the bank simply pays them immediately to the suppliers providing the buyer with time to pay.

Points to note.

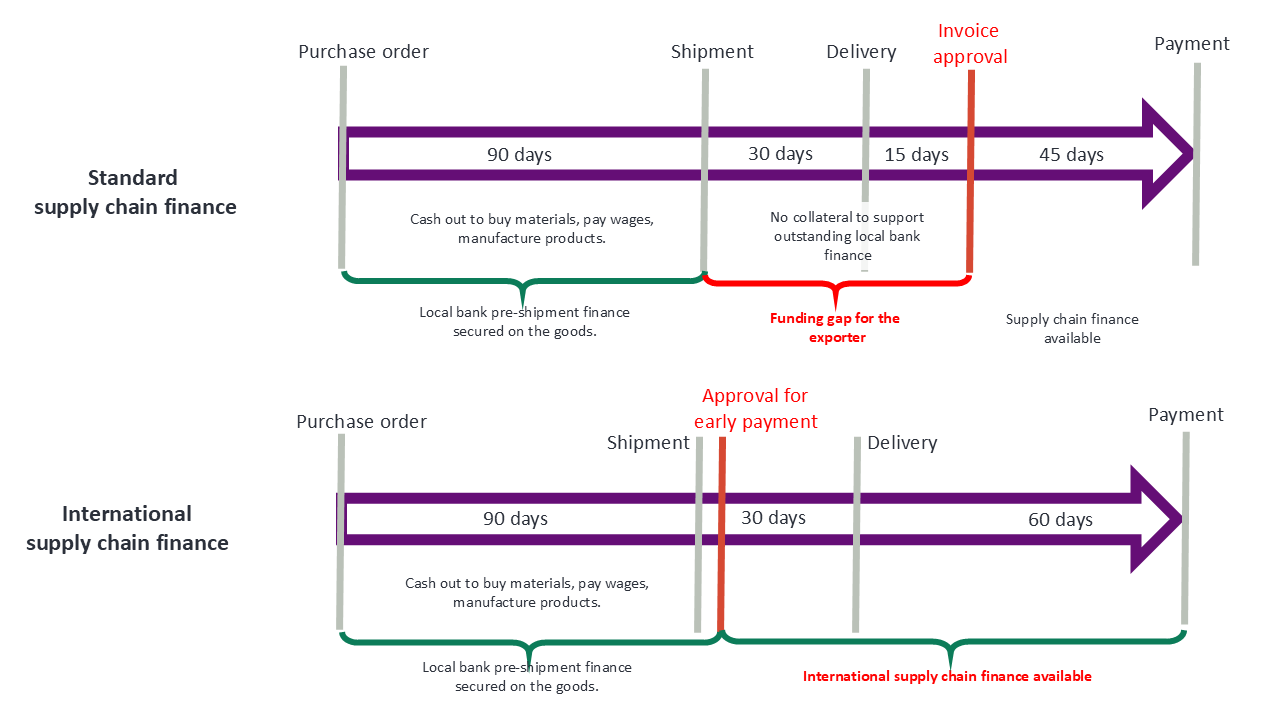

Supply chain finance usually delivers payment to suppliers after delivery. It does not provide finance for the shipping period, so (in this form) cannot really be called trade finance.

Suppliers have to hand over the goods and trust that the buyer will approve the invoice.

But with only one bank and the whole process being driven by the buyer approving invoices:

It operates at scale

Is cheap and efficient to run

Once the invoice is approved, payments happen very quickly

Only one bank is taking fees out of the process, and that is simply for acting on the buyer's confirmation that the invoices are good to pay.

SCF versus trade finance - the PrimaTrade model

The PrimaTrade platform takes the best out of both products to provide a new hybrid solution - "international supply chain finance". See our post here for a full description.

International supply chain finance

We take the good points from each product:

There is only one bank

Arrangements operate simply and at scale - the buyer confirms invoices are good to pay, and the buyer's bank pays the suppliers.

So far, this is supply chain finance. The innovation comes from the support provided to the buyer by the PrimaTrade platform, enabling the buyer to pay the suppliers before delivery, if not at shipment.

Suppliers upload their shipping and other paperwork.

The paperwork is converted into data, warranted by the supplier and this data is then used to see if the transaction is compliant with the buyer's requirements.

This is a similar process to a classic trade finance product - enabling the buyer to give an approval very quickly and before delivery.

We call this process "cash against data" to distinguish it from the "cash against documents" model of classic trade finance described above.

The benefits of international supply chain finance

There are many wins that both suppliers and buyers can obtain when the PrimaTade international supply chain finance product is used:

Suppliers are paid before buyers get control of the goods. This helps suppliers with the local financing position. It is a trade finance solution.

Buyers have a reliable way to make a decision on payment before delivery - enabling cash to be accelerated efficiently by the buyer's bank to the supplier.

It is usually more efficient for everyone involved if suppliers can be paid this quickly:

suppliers save on their own borrowing costs

suppliers can avoid credit insurance

suppliers avoid a collateral gap because they hand over control of the goods only after the cash has been received

PrimaTrade provides a way for buyers to crystallise a benefit from this effficiency via automated discounts on invoices.

SCF versus trade finance? Why not have the best of both worlds and use interational supply chain finance?

Next steps

Give us a call or send us an email to discuss!